|

|

|

|

|

Attaining sustainability through IR Adoption: A case study analysis

Devarapalli Suman 1![]() , Lalita Mohan Mohapatra 2, Reon

Matemane

, Lalita Mohan Mohapatra 2, Reon

Matemane

1 VR

Siddhartha Engineering College, Deemed to be University, Vijayawada, Andhra Pradesh-520007,

India

2 2Paari

School of Business, SRM University-AP, Guntur, Andhra Pradesh- 522502, India

3 Faculty of Economics and Management Sciences; Department of Financial

Management; Room 3-15; Level 3; EMS Building, University of Pretoria, Private

Bag x20; Hatfield Campus, 0028, South Africa

|

|

ABSTRACT |

||

|

The study’s

intention is to explore the development of Integrated Reporting (IR)

disclosure practices in India and identify emergency of IR at global context

and Indian context. The adoption of IR framework will improve the disclosure

levels of both financial and non-financial information and improves value

creation mechanism. The capitals are the basic components to address

environmental, social, human, and intellectual issues under the IR framework.

The sample size consists of 176 Indian listed companies observed over five

years i.e., 2018- 2022. The study has employed a separate content scoring

mechanism to assess IR disclosures through integrated annual reports and, also

adopted a qualitative case study analysis of early IR adopting Indian

companies. Through case study analysis, the study identified that companies

disclose most of the vital IR elements, and covered natural, human, social

and intellectual aspects and made communication easy to different stakeholder

groups. The content analysis disclosed that IR trend moderately improved and

further distinguished that the IR is quite different from other promising

reports like traditional financial reports, sustainability report, and

corporate socially responsible reports. The preparers, professional bodies

and regulators must extend their support to have quality IR framework

practice and meet the obligations of stakeholders in generating value to the

firm. |

|||

|

Received 10 November 2024 Accepted 21 December 2024 Published 31 December 2024 Corresponding Author Devarapalli

Suman, dsuman@vrsiddhartha.ac.in

DOI 10.29121/ShodhPrabandhan.v1.i1.2024.7 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2024 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Integrated Reporting, Content Analysis, Case Study

Analysis, and Promising Reports |

|||

1. INTRODUCTION

In the present scenario, expectations on the business environment are increasing significantly. Even, globalization has made the world’s economy as integrated, which created competition, and technology innovation, increasing the government rules and regulations across the globe (Adams & Simnett (2011)). The faith in financial corporations has been reduced because of several issues like corporate scandals and financial market crises (Flower (2015)). This led to thinking about environment, social and governance (ESG) parameters by different groups including media, corporate personnel, capital providers and stakeholders (Eccles et al. (2015)). All the companies are players in the market, and they dream to reach the expectations of stakeholders and fulfil their interests (Cheng et al. (2014)). So, communication is one of the vital sources to disclose information to company’s bounded users (Eccles & Krzus (2010)). It is observed that companies follow different styles of reporting practices in different countries as per their government policies, industry regulations and country’s economic policies (Flower (2015)). The traditional financial reporting is the basic element that every company choose to communicate the information to all interested parties (Adams & Simnett (2011)). Often, the traditional reports provide only historical trends, and lack in providing forward-looking information (Eccles & Krzus (2010)). In the context of globalization, the traditional financial reports fail to meet the needs of various stakeholders and environmental obligations (Adams & Simnett (2011); Cohen et al. (2012); Dumay et al. (2017)). Further, society is raising a few assumptions on organizations’ survival in creating wealth, creating value for people, common society, and the environment (Gray (2006)).

The “IR provides a chance for companies to disclose a holistic view of business activities in a clear, brief, comparable, and connecting all key elements of business (Sun (2012)). So, IR focuses mainly on the concept of materiality, which concentrates on organizations’ strategy, governance mechanism, and performance of economic, social, and environmental aspects (Owen (2015)). The essence of IR is to understand the association between firms’ economic performance and firms’ ESG performance and they are connected to communicate information to interested parties (Eccles et al. (2015)). The IR provides business opportunities, minimizes business risk, increases business performance, improves business growth, and identifies early warning signals (Eccles & Krzus (2010)).

1.1. Significance of the study

IR is a novel concept that has not been deeply investigated in developing countries like India. The prior research on IR adoption, and quality strongly recommends to examine deep in this area either country wise or within the country. The intention of this research is to present a conceptual, and theoretical evidence of the IR framework on Indian listed companies. In addition, the research work provides deep understanding of the IR framework’s proposed capitals, content elements, guiding principles, and value creation process. This study provides insights into how IR is different from other reports and IR adoption trends in India. Further, this research would provide mean trends of IR quality disclosure and a case study analysis of top IR adopted companies. Finally, the study would like to answer the following research questions.

RQ1. To what level do BSE-listed companies in India encompass the constituents of the IR framework in their annual reports or integrated annual reports?

RQ2. How IR is different from other reports?

RQ3.Whether case study of sample companies disclose IR information as per recommendations?

RQ4. Whether mean trends of IR quality is improved?

The remaining paper is arranged as follows. Chapter 2- Review of literature, Chapter 3- Research Methodology, Chapter 4- Case Study Analysis of top IR disclosed companies, Chapter 5- Presence and endorsement of IR Framework Chapter 6 includes conclusion.

2. Review of Literature

The idea of “Integrated Reporting” has grown significantly in the field of corporate reporting during the past decade. This section provides an assessment of the scholarly literature on the IR adoption and IR disclosure. The following sections comprise the literature review in the global and Indian context.

2.1. Prior IR studies in the Global context

Hammond & Miles (2004) evaluated the corporate reports in the UK and conducted semi-structured interviews with sixty individuals from thirty-one companies. The quality of the corporate reporting is not satisfactory to disclose sustainability information. Adams & Simnett (2011) explained the concepts, and principles of IR, and the role of capital in producing value for the stakeholders and for business. Further, Eccles & Saltzman (2011) described the function of civil society in promoting the quality of IR and benefits for the company and for the stakeholder groups. Krzus (2011) explained the role of corporate reporting, relevance of report, complexity of reports, future trends in corporate financial reporting, and key benefits of IR. Maroun (2019) found external assurance quality significantly enhanced the IR disclosure and received support from external authorities. Vitolla & Raimo (2018) suggested that the adoption of IR depends on the decision of top management and stakeholders received benefits from IR adoption. Lai et al. (2018) emphasised the intention of the preparers with reference to the IR adoption and revealed that the potential stakeholders understood the need for IR disclosure.

In the context of international settings of IR adoption, Frias-Aceituno et al. (2013) found that firm size, and profitability has a substantial relationship with the voluntary disclosure of IR information. Garcia-Sanchez et al. (2013) found IR disclosure has a significant association with country level, firm level, firm size, and profitability. Similarly, Vitolla et al. (2020c)) justified that profitability (ROE), firm size, leverage, board size and civil law system have significant relationships with IR quality. Iredele (2019) reported significant relationship between the quality and the length of the report. Similarly,

found a significant relation between company’s characteristics and IR quality index. In addition, Lopes & Braz (2020) discovered that larger board size, greater presence of non-executive board members, and board diversity have substantial effects on disclosure of quality IR information. Abeysekera (2010) identified larger boards significantly improve intellectual capital disclosure. Vitolla et al. (2020b) noted board attributes have substantial on the disclosure of intellectual capital. Rambaud and Richard (2015) elaborated on the capital for value creation and removed the sustainable issues with the IR framework. Setia et al. (2015) noted capital disclosure has significantly enhanced and meets stakeholders’ requirements. Haji & Hossain (2016) justified that the companies disclose IR information with capital trade-offs and capital interdependencies significantly. De Villiers and Sharma (2020) found the disclosure levels of intellectual capital significantly influenced the IR disclosure. In contrast, Suttipun (2017) found financial performance has an insignificant association with natural capital. Similarly, Trebucq and Magnaghi (2017) also found capital disclosures require more improvements. Terblanche and De Villiers (2018) found that intellectual capital (IC) information was not disclosed according to the interest of stakeholders.

In the mandatory context of the IR framework, Lee & Yeo (2016) noted IR disclosure has positive association with firm value, and the higher the IR disclosure will have greater valuations. De et al. (2017) found type of industry, firm size, profitability, and members of the board have a positive association with IR quality. On similar grounds, Dube (2018) identified the IR quality has significantly affected the firms’ financial performance. Nurkumalasari et al. (2019) found that IR quality has a positive association with firm valuation, while IR quality increases the publication of accounting information. The results of Albetairi et al. (2018) noted that the IR quality has a significant association with firm’s performance. The conclusions are steady with Barth et al. (2017) found IR quality has a positive association with liquidity and expected cash flows. While higher quality of IR significantly enhanced investment efficiency.

2.2. Literature review in the Indian context

Athma & Rajyalaxmi (2013) as well as Misra & Agarwal (2011) examined the growth of IR and its importance on the sustainable goals and emphasized the role of IR in the globalized world. Prajapati et al. (2014) elaborated the initial growth of the IR in India, trends in corporate reports, and the need for the IR disclosure. Similarly, Hossain (2021) presented the insights, growth, importance, competitive advantage, and components of the IR disclosure for various countries. Abhishek et al. (2020) reported positive approach from different communities like academician, accountant, and auditors for the IR. Singh et al. (2019) found the firm’s leverage, and firm’s size has an insignificant association with financial performance of companies. Ashok (2019) found Extensive Business Reporting language (XBRL) significantly improved the IR growth in India. Further, Bal & Sunil (2020) justified IR adoption enhances the corporate reporting. In voluntary context of IR adoption, Soriya & Rastogi (2023) found IR quality disclosure has positive association with profitability, and insignificant relation with firm value.

2.3. Research Objective

The traditional annual reports disclose mostly financial-related information, but this information is not sufficient to measure the ability of value generation by the companies. Therefore, suitable disclosure is required for non-financial performance. The study would like to fulfil the following objectives.

1) To elucidate the background of IR along with eight content elements, and seven guiding principles of IR framework. Also, enumerate global adoption of IR

2) To understand how IR is different from other reports.

3) To analyze mean trends of IR and adopting of IR companies in India.

4) To understand reporting practice of top eight Indian IR adopting companies through Case study analysis.

3. Research Methodology

3.1. Population

Based on the report of Vrushali (2019), AICL. (2020), and Grant (2020) noticed that around 80 plus companies disclosed IR information in India. The Securities Exchange Board of India’s circular in 2017 has encouraged top 500 Bombay Stock Exchange (BSE) listed companies to disclose IR information. The final sample includes 179 IR adopted companies in India.

3.2. Sample design

The current study used a purposive sampling method under the non-probability sampling techniques to select the IR adopting companies in Indian context. The selection sample is based on researcher’s present knowledge and judgement on IR adoption by the Indian companies after SEBI circular in 2017.

3.3. The Time Period and Source of data

The present study has been carried out over a period of 5 years i.e., 2018 to 2022 financial year. The study proposed both case study analysis of top IR adopting companies, and secondary data analysis. The data for all the corporates were extracted from annual reports of individual companies. The mean trend of IR quality variable was developed by using the content analysis method.

3.4. Content analysis

To compute the disclosure index, the study has proposed a self-developed checklist on eight content elements and multiple capitals in accordance with Integrated Reporting Framework (IIRC. (2013)). Content analysis technique is extensively used by Agustia et al. (2018), Soriya & Rastogi (2023) who proposed IR index based on eight content elements and seven guiding principles of IR framework. Similarly, Lee & Yeo (2016), Setia et al. (2015), Dragu & Tiron-Tudor (2013), Sofian & Dumitru (2017) proposed IR index based on eight content elements of IR framework. This study examined annual reports or integrated annual reports of Indian IR adopting companies during 2018 to 2022. The present study assigns a score of zero in the absence of individual attributes and allocates a score of 1 if the individual attributes are presented in the annual reports. The disclosure checklist included 55 items within eight content elements of IR framework, and assigned scores accordingly. Further, every individual element score ranges between zero to ten and overall content elements score ranges between 16 to 80. The disclosure score is converted to disclosure index by using a mathematical equation. The IR index has maximum percentage is 100 and minimum percentage is 29.

![]()

Where IRQit = Integrated Reporting Quality of the firm, CEit = Scores allotted for individual content elements, TPC = total possible score.

4. Case Study Analysis

The study has chosen top eight IR adopting Indian companies, which have more than 5 years of IR disclosure through their annual reports they are (i) Larsen and Toubro Ltd (L & T Ltd), (ii) ACC Ltd, (iii) Reliance Industries Ltd. (RIL), (iv) Tata Steel Ltd, Tata Metaliks Ltd, Dabu India Ltd., Wipro Ltd, and Yes Bank Ltd. The case study analysis is presented in Table 1 and Table 2.

Table 1

|

Table 1 Case study analysis of selected sample companies |

||||

|

Items |

ACC Ltd. |

L & T Ltd. |

Reliance Industries

Ltd |

Tata Steel Ltd. |

|

Adoption |

2017- 2018 FY |

2017-2018 FY |

2015-2016 |

2015 to 2016 FY |

|

Business Model |

The business model is presented with vital

elements and SDGs |

The business model is presented with vital

elements and SDGs |

The business model is presented with vital SDGs |

The business model is presented with key business

elements. |

|

Capital descriptions |

There is clear indication of one capital

trade-off with other capitals. |

Capitals are

elaborated with other elements |

Capitals are

elaborated with KPIs. |

There is clear indication of one capital linkage

with other capitals. |

|

Stakeholders

Engagement |

There is complete classification of groups and

their involvement. |

There is dynamic

engagement with all groups with material issues. |

Presents all

stakeholders engagements with strategic objectives. |

Presents various key stakeholders, and value

proposition. |

|

Materiality |

Presented with measures and linked with capitals. |

Done survey and

considered 15 material items with matrix |

Considered material

items with matrix and their impact. |

Presented with measures and linked with KPI's and

ESG. |

|

Risk and Opportunities |

Identified various business risks and

opportunities. |

Highlighted various

business risks and their influence |

Presented various

business risks and opportunities and their interlink with key elements. |

Presentation of element in the report with

strategic linkage and capitals. |

|

ESG’ parameters |

All ESG's factors are linked with business

strategies, and materiality. |

Disclosed all elements

with capital influence, and material impact. |

ESG factors are linked

with material, and capitals linkages. |

All ESG's factors are linked with capitals,

business strategies, and KPI's. |

|

SDGs goals |

Sustainable goals are

linked with SGDs. |

Cleared presented SDGs

achievements. |

SDGs are presented

under each capital. |

All SDGs are

interlinked with capitals |

|

Assurance |

There was independent assurance from KPMG. |

DNV business assurance India private ltd. |

There we independent

assurance from EY |

independent assurance from Price Waterhouse &

Co. |

|

Covid support (Under CSR) |

2,14,489 lives were touched & supported covid

crisis. |

1.36 Bn CSR spent, and met covid obligations. |

Spent 771 crores and faced covid crisis

positively. |

Done their best to

support society |

|

Business Strategies |

All are presented with

capitals influences |

Objectives are

presented with SO(1), SO(2), SO(3), & SO(4) and interlink with capitals |

Presented with

capitals influence and materials effected. |

Strategies are linked with SDG's and key material

issues. |

Table 2

|

Table 2 Case Study Analysis of Selected Sample Companies |

||||

|

Items |

Tata Metaliks Ltd. |

Dabur India Ltd. |

Wipro Ltd. |

YES Bank Ltd. |

|

Adoption |

2017- 2018 FY |

2016-2017 FY |

2015-2016 FY |

2015 to 2016 FY |

|

Business Model (BM) |

In initial year IR adoption,

there was plain BM and in passing years the company incorporated SDGs in

their annual reports. |

Included value chain,

SDGs mapping, Indian and International business operations. |

Presented with

stakeholder groups, strategies, and financial trends. |

Is a simple model that

describes with core elements of bank operations. |

|

Capital descriptions |

Presented with capital-trade-offs, influence on

SDGs and other vital elements. |

In every passing year

capital information is added to repots |

There is

inter-relationship among the capitals and effect on SDG’s |

Each capital is

enumerated with complete data. |

|

Stakeholders

Engagement |

Stakeholders’ groups

are segregated on relevance, aspirations, and focused areas |

There is frequency

engagement monthly, daily, quarterly, and yearly |

Identifies

stakeholders through lens of impact, interest, legitimacy, and influence. |

Mentions each stakeholders needs and

requirements. |

|

Materiality |

Presented from 2019

reports and highlighted with ESG issues. |

Marked 19 items in

2022 and presented in map with parameters |

Map is presented with

ESG elements. |

No specific matrix but issues are presented under

various risk items. |

|

Risk and Opportunities |

There was complete risk management mechanism in

the company. |

Measured under

potential impacts, mitigation strategies and capital impacted. |

Developed a framework:

guiding pillars, risk strategies, eco system, and process. |

Banks’ various risk presented. |

|

ESG’ parameters |

ESG KPI’s are

presented under individual capitals with their interlinks. |

Presented with

material issues and aligned with capitals for easy tracking. |

ESG factors are

presented under material concept. |

Each capital is

enumerated with complete data and ESGs are discussed with capitals. |

|

SDGs goals |

SDG are discussed

under various capitals. |

Highlighted under each

capital and their impact. |

Presented under each

capital with positive and negatives. |

All SDGs are

interlinked with capitals |

|

Assurance |

There was independent assurance from PwC. |

Walker Chandiok &

Co LLP |

DNV GL & Co Ltd |

Independent assurance from KPMG India Ltd. |

|

Covid support (Under

CSR) |

Extended their support under CSR activities. |

Provided salary for 12

months and touched 7,80, 980. |

Spent more than 244 Cr

to provide facilities. |

Extended their support

during the crisis. |

|

Business Strategies |

Strategies are linked

with capitals and various stakeholders. |

With strong 138 years

of existence, modernizing ayurveda, & rural expansion |

Developed four

strategies for business. |

Are presented with diagram with six key topics. |

5. Presence and endorsement of IR Framework

Most of the research is either done in mandatory context or voluntary, but limited research work has been done in Indian context, specifically focusing on IR quality. Being the adoption of IR by Indian companies slowly getting improved and it is necessary to investigate what are the companies that disclose IR information and understand their trend along with global adoption of IR adoption. To fill the research gap on IR, the preparers, policymakers, and academic researchers must understand how IR is differentiated, associate and share information accordingly.

5.1. International Integrated Reporting Framework (IIRF)

This part includes one of the objectives of this research work. The International integrated reporting council (IIRC. (2013)) has proposed an IR framework to show the right directions to companies that are like to instigate IR. The focus of IR is to identify business risk and opportunities and vital information related to the value generation of an organization in various time frames (Dumay et al. (2017)). The fundamental concept, eight content elements and guiding principles accentuate a future forward-looking disclosure (Owen (2015)). The IR framework is not accounting and rule based rather it is principle-based report that concentrated on vital fundamental concepts, capitals, seven guiding principles, and eight content elements.

5.2. The fundamental concepts of Integrated Reporting Framework (IRF)

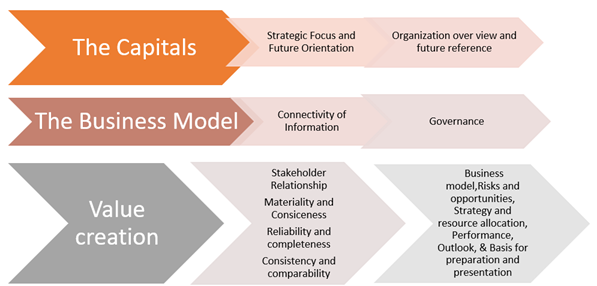

The IR framework induces three types of fundamental concepts (I. value creation for organization and for others, II. the multiple capitals and III. the value creation process). These fundamental concepts help the organization to create value in different time intervals within the organization alone. The value creation is influenced by several external factors, by maintaining healthy association with stakeholders and by depending on business resources. The fundamental concepts of IRF are shown in below Figure 1.

Figure 1

|

Figure 1 Fundamental Concepts of IRF |

5.2.1. The capitals

Most organizations rely on diverse forms of capital for their achievement. The capitals are just like inventory/ stock of value that might improve, decline, or transform through business activities and outputs of the organizations. The categories and descriptions of capitals are presented in the below Table 3.

Table 3

|

Table 3 Capitals with Basic Descriptions |

||

|

Capitals |

Basic Description |

Examples |

|

(i) Financial Capital |

Covers complete information about internal and

external sources of funds that are used to produce goods and services. |

Debt, Equity, profit, inflow, and outflow of

cash. |

|

(ii) Manufacturing Capital |

Physical objectives that are utilised by the

organization to produce goods or services. |

All Tangible Assets. |

|

(iii) Intellectual Capital |

Knowledge based abilities possessed by the

organization in the form of intangible assets. |

All Intangible Assets. |

|

(iv) Natural Capital |

Highlights the role of renewable and

non-renewable resources and initiatives taken by the organization towards

environment protection with the help of resources. |

waste management, water recycling, and

biodiversity |

|

(v) Human Capital |

There is no value for goods or service until

employees create value through their own output or contribution, that results

in the success of every organization. |

Employee competence, capabilities, experience,

technical skills, and other attributes. |

|

(vi) Social and Relationship Capital |

For long-term survival, the company need to build

a strong association between stakeholder groups, social communities, and

other vital networks through social activities. |

Amount spent for social well-being, and

facilities provided to the society. |

|

Source IIRC (2013) |

||

5.2.2. The Content Elements

The main intention of these eight content elements is to integrate these elements in a useful way to inform about the organization’s success or failure to interested stakeholder groups. The eight content elements proposed by the IR framework is presented in Table 4 (IIRC. (2013); De et al. (2017)).

Table 4

|

Table 4 Eight Content Elements with Basic Descriptions |

|

|

Content Elements |

Basic Description |

|

(i)

Organization over view and External Environment |

The IR enhance the firms to disclose quality

information which includes essential market conditions, industry trends,

globalization, market position, technology changes, competitive advantage,

ownership & structure of the organization, culture, ethics, bargaining

power of customers, mission, and vision of the organization. |

|

(ii) Business Model |

The business model includes inputs, outputs and

outcomes of multiple capitals that aims to fulfil the organizations’ goal or

strategic objective. The virtuous circle assists the firms to create value in

different time interventions and receive positive investments from investors. |

|

(iii) Governance |

Type of leadership, range, skills, abilities,

gender competence, systematic decision making, legal requirements, culture of

the organization, how personnel remunerations, and intensives are associated

with value creation in different time intervals. |

|

(iv)

Strategy and Resource allocation |

Organizational strategies are proposed to achieve

strategic objectives at different time periods. The degree to which

environmental and social concerns have been combined into the organization’s

strategy to gain a competitive advantage. Knowing its present position and

targeting where it wants to be placed. |

|

(v) Risk and Opportunities |

The IR enables organizations to mitigate several

key risk elements or to create value over time. |

|

(vi) Future Outlook |

The organization must make sure that all stated

outlooks, objectives, and intentions are grounded. Assessment of actual

performance to earlier set targets enables to examine the present outlook. |

|

(vii) Performance |

Building association between past and present

performance, and between present and future orientation. Key performance

indices (KPI) merge financial information with other vital components. |

|

(viii) Basis for preparation & presentation |

A summary of substantial frameworks, and methods

used to present the quantifying information. |

5.2.3. Seven Guiding Principles

The IR framework proposed seven guiding principles which are used to prepare quality IR.

1) Strategic

focus and future orientation

· Espousing a strategic focus and future orientation helps the firms to achieve their objectives through significant capital contribution.

· The IR helps organizations to learn from previous experiences and fix future strategic goals and directions.

2) Connectivity

of information

· Integrated thinking is incorporated into an organizations core activity, which naturally connect or link key information with management reporting disclosure, and then into the final integrated report.

· Quantitative and qualitative information is presented within the boundaries of IR.

3) Stakeholder

relationships

· The value is not generated within the boundaries of an organization but it is generated with the association of other groups.

· The IR provides important insights to stakeholders (economic, social, and environmental obligations).

· The IR improves transparency and accountability, which are important in building trust and resilience, among stakeholders and focused more on fulfilling legitimate requirements, and interests.

4) Materiality

· The materiality determination process includes (a) identifying important relevant matters, (b) evaluating vital matters, and (c) prioritizing relevant matters, which are used to report and present an integrated report.

· The materiality includes both positive and adverse matters (risk elements, business opportunities, favourable and unfavourable market performance, or prospects). Even the concept of materiality includes financial and other financial matters.

5) Conciseness

· Adopts a logical pattern or structure that would include organizations suitable internal cross-reference and restrict repetition of reference.

· The IR helps organizations to connect information that does not switch regularly or external sources.

6) Reliability

and completeness

· It is suggestable to have an audit trail before presenting or preparing the IR.

· The concept of reliability is affected by its freedom and perfect balance from material flaws.

· The reliability of information is improved by internal control, reporting mechanism, assurance statements from independent and external parties, stakeholders’ engagement, and quality of internal audit.

7) Consistency

and comparability

· It is advised to follow reporting guidelines consistently from one time to the next time until a change is required to enhance reporting quality of an organization.

· The comparability of the information is improved by using benchmark data like disclosing data in the form of ratios or trends.

5.3. The emergence of IR framework

The first King Code of Corporate Governance Principles was released in the year 1994 in South Africa, commonly known as ‘King’ 1, Named after Mervyn King, mainly called a justice of the Supreme Court of South Africa (Owen (2015)). As King 1 has used the term ‘Inclusive Stakeholders’ rather than merely stakeholders, and this is the year where the IR journey has started unofficially (Gleeson (2014)). The “Integrated Sustainability Reporting” was instituted as a concept in Kings II reports, which includes details of the new, and complex nature of non-financial reporting (Owen (2015)). This incipient report has its initial footnotes with the Global Reporting Initiative (GRI) and Triple Bottom Line (Dumay et al. (2017)).

After the ruin of Enron and WorldCom, some parts of King II initiated reports espoused by one of the top stock exchanges i.e., the New York Stock Exchange (Sun (2012)). Thus, King’s II report on corporate governance has positively established significant international corporate governing principles in the world (Dumay et al. (2017)). According to the King III reporting guidelines, the IR contains few sets of principles, as they are espoused by the Johannesburg Stock Exchange (JSE) on 1st March, 2010, and mandated IR on a voluntary “apply or explain basis” (Institute of Directors of South Africa, 2009; Sun, 2012). South Africa is the only nation to follow IR mandatory for all the companies listed in Johannesburg Stock Exchange (Institute of Directors of South Africa, 2009; Lee et al. (2016)). The IIRC. (2011)discussion paper noted IR as main the communication tool for non-financial information in the 21st century IIRC. (2011). The council requested various groups to submit their comments/feedback within three months of the issue of the discussion paper (Dumay et al. (2017)). It was also available in the public domain for almost three months for feedback and suggestions. The council has received feedback from the various stakeholders on the discussion paper. Soon after that, the IIRC issued a consultation draft in 2013, April (IIRC. (2013)). After the complete study of the consultation draft the IIRC issued/released the international IR Framework worldwide in December 2013 (IIRC. (2013)).

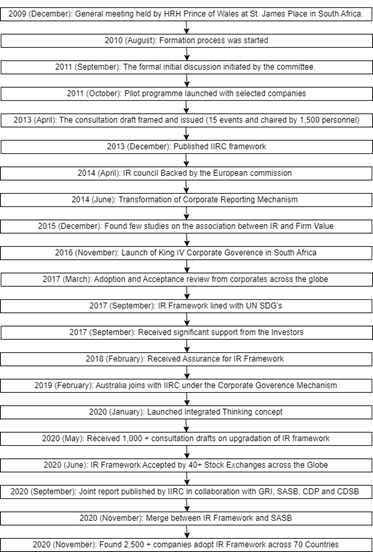

As, IIRC is a non-profit motive organization and it is a global coalition of various standard setters, policymakers from several organization, accounting professionals from esteemed accounting bodies, renowned capital provides, NGO’s, academic professionals, and managerial personnel (IIRC. (2013)). The IIRC has released one decade journey report. The Figure 2 discloses pictorial presentation of IIRC journey.

Figure 2

|

Figure 2 Journey of IR Framework |

5.4. Global countries and stock exchange contributions towards IR adoption

After the proposal of a new reporting style by the IIRC, several companies incorporated IR practice in their annual reports. Firstly, South Africa was the first nation to promote IR and request all the listed companies to disclose IR on a compulsory basis. To improve integrative-ness in present disclosure, the Integrated Reporting Committee of South Africa (IRCSA) was established in 2011. A report from Ernst & Young-EY (2012) highlights that some notable stock exchanges are following sustainable practises like, Sao Paulo, Singapore, Kuala Lumpur, and Copenhagen. Even, France made significant progress towards IR adoption by passing Grenelle II Act in 2012. In April 2013, the European Commission announced to improve the fourth and seventh accounting directives to promote and encourage better IR disclosure (IIRC. (2013)). This is the best time for leading business organizations in the world to adopt and implement IR in their reporting practices and they can present their business performance through the Business model and generation of value in different segments. The notable stock exchanges and countries list is presented in the following Table 5

Table 5

|

Table 5 Popular IR Participated countries Across the Globe |

|

|

Country |

Description |

|

South Africa |

All listed companies in JSE (Johannesburg Stock

Exchange) should disclose the IR framework from 2010 and it is 1st

nation to mandate IR framework. The IIRC has a separate IR committee in South

Africa. |

|

Canada |

Voluntary disclosure of IR framework and requests all

listed firms to follow and found only twelve companies to practice this

framework. |

|

United Kingdom |

UK treasury called all public sectors to adopt IR for

communication. |

|

United States of America |

Voluntary adoption of IR and found 35 companies

following the guidelines. The IIRC has a separate IR committee in the USA. |

|

Australia |

The IR guidelines are issued by an Australian stock

exchange’s 3rd edition on corporate governance principles and

recommendations. The IIRC committee in Australia is called “Australia

Business reporting leaders.” |

|

France |

Voluntary adoption of IR and found 108 companies are

following the guidelines. |

|

Sweden |

Voluntary adoption of IR and found 30 companies are

following the guidelines. |

|

Spain |

Voluntary adoption of IR and found 68 companies are

following the guidelines. |

|

Switzerland |

Voluntary adoption of IR and found 16 companies are

following the guidelines. |

|

Malaysia |

The Malaysian government and Securities Commission in

Malaysia support the IR framework. More than 20 large-scale industries

started to follow the IR framework model voluntarily. |

|

Singapore |

Singapore stock exchange passed a note to adopt IR

framework for all listed companies. |

|

New Zealand |

The External Reporting Board (ERB), National Standard

Setter and the New Zealand financial reporting act 2013, accounting,

auditing, and assurance standards for profit, not for profit organizations.

All these standard boards and regulation acts promotes the IR framework in

New Zealand for value communication. |

|

Japan |

Ministry of economy, trade and industry in Japan

endorses IR framework for long-term value communicating. More than 300

companies started to follow the IR framework voluntarily. |

|

China |

Voluntary adoption of IR and found 50 companies are

following the guidelines. |

|

Brazil |

The Brazil stock exchange BM & BOVESPA encourages

all listed companies to disclose IR reports or explain the principles. |

|

Argentina |

Voluntary adoption of IR and found 15 companies are

following the guidelines. |

|

Peru |

Voluntary adoption of IR and found 5 companies are

following the guidelines. |

|

Russia |

Voluntary adoption of IR and found 28 companies are following

the guidelines. Russian IR committee (Under development) |

|

Philippines |

Voluntary adoption of IR and found 20 companies are

following the guidelines. |

|

Sri Lanka |

Voluntary adoption of IR and found 65 companies are

following the guidelines |

|

Italy |

Italian Foundation for Business Reporting (OIBR

Foundation) suggests all companies to follow the IR framework. |

|

German |

The Schmalenbach working group on IR German. |

|

Turkey |

Started to promote IR framework through IR Turkey

Network (ERTA) |

|

Bangladesh |

Request all listed companies to follow the IR framework

on a voluntary context. |

|

Singapore |

Requested all listed companies to follow IR framework

disclosure. |

|

India |

SEBI has passed a circular stating that all 500 listed

BSE companies can go for adopting the IR framework on a voluntary basis from

2017 onwards. |

|

Brussels: The

European Commission supports IR framework adoption. Some European countries

start practising the IR framework like France, Germany. Italy, Turkey,

Switzerland, the UK, and the Netherlands. IR

Council of Africa: Suggests all African counties to follow IR framework

guidelines. IR ASEAN

committee |

|

|

Source Authors own Compliance |

|

5.5. How IR is different from other reports

Table 6

|

Table 6 Difference Between Integrated Reporting and Traditional Reporting |

||

|

Integrated Reporting |

Traditional Reporting |

|

|

Focus |

Trends related to past, present, and future are

associated with business strategies (IIRC, 2013). |

Limits with only present and past financial

trends (Hoque, 2017) |

|

Timeframe |

It is focused on value creation in different

frames periods, and presents holistic representation (Eccles and Krzus,

2010). |

Concentrated only for short -term period and

creates value in historic nature (Hoque, 2017). |

|

Conciseness |

Precise and much focused on material aspects

(IIRC, 2013). |

Long and includes complicated information (Hoque,

2017) |

|

Compliance |

It is principal based and more approachable to

stakeholders (IIRC, 2013). |

It is bounded by accounting rules and regulations

(Flower, 2015). |

|

Presentation |

Reports with innovative technology |

Less and more over paper -based. |

|

Thinking |

Integrated thinking helps to endorse integrated

reporting (IIRC, 2013). |

Things only on financial reports (Jensen and

Berg, 2012). |

|

Stewardship |

Highlights six capitals for value creation and to

improve the brand image (Dumay et al., 2017). |

Focuses more on financial capital to present firm

image (Hoque, 2017). |

|

Trust |

It is more transference (Eccles and Saltzman,

2011) and links both financial and non-financial reports. |

It is less transference (Weybrecht, 2010) and no

association between financial and non-financial data. |

|

Nature of Adoption |

It is completely voluntary basis. |

It is on a compulsory basis. |

|

Report Category |

It discloses various reports into single report

(like Sustainable reports, CSR, and financial reports) (Eccles and Krzus,

2010) |

It highlights only individual financial and

social reports (Jensen and Berg, 2012). |

|

Targeted users |

It is mainly focused on capital providers and

main stakeholder groups (Jhunjhunwala, 2014). |

It is only meant for fund providers and limited

stakeholders’ groups (Simnett and Huggins, 2015) |

|

Risk disclosure |

Risk is minimised through quality corporate

governance mechanisms (Eccles and Saltzman, 2011). |

Lacks complete disclosure of risk, and fails to

minimise risk elements (Serafeim, 2015). |

|

Expectations |

Meets the expectations of all stakeholder groups

(Serafeim, 2015; Eccles and Krzus, 2010). |

Lacks the expectations of stakeholder groups

(Hughen et al., 2014). |

|

Source Authors own compliance |

||

Table 7

|

Table 7 Difference Between Integrated Reporting and Sustainable Reporting (Busco, 2013; Houqe, 2017) |

||

|

Sustainable reporting |

Integrated Reporting |

|

|

Object |

It presents the firm’s impact on disclosure of ESG parameters. Also, try

to present risks & opportunities in a transparent. |

It explains various capitals and their use by the firms in creating value

in short-, medium-, and long-term basis. |

|

Whom they target |

Few stakeholder groups |

Capital providers, stockholders, and external stakeholders. |

|

Adoption |

In more than 100 countries GRI is adopted |

Adoption is slow and around 40 countries disclosure voluntary basis

except for South Africa |

|

Content elements |

ESG with various parameters |

Eight content elements, six capitals, seven guiding principles, a

business model, value creation process with various parameters. |

|

Capitals target |

Natural, social & relationship and human capitals |

Six capitals: financial, social & relationship, natural, human,

intellectual and manufacturing capital. |

|

Subjects |

Environmental matters, Social

matters, and Governance related matters. |

Financial statements, management discussion analysis, Governance

information, CSR reports, Environmental, audit reports, and IR reports. |

|

Information type |

Only non-financial (ESG) |

Contains both financial and non-financial information. |

|

Connectivity |

Not necessary to relate ESG to financial matters. |

It is compulsory to correlate financial and non-financial information. |

|

Compliance |

Mandatory in a few countries and the rest is on a voluntary basis. |

Mandatory only in South Africa, and the rest on a voluntary basis. |

|

Emphasis |

Only long-term basis |

Includes short-, medium- and long-term basis. |

|

Time |

Backward and forward-looking statement. |

It also includes both forward and backword looking. |

|

Stander setters |

GRI framework issues G4 guidelines for sustainable issues. (Source: GRI,

2013) |

IIRC framework and includes different standard setters for formulating

guidelines, like GRI, SASB, and other renowned institutions. |

|

Source Authors own compliance |

||

Table 8

|

Table 8 Difference Between Corporate Social Responsibility and Integrated Reporting |

||

|

CSR |

IR |

|

|

Objective |

Focus mainly on social concern. |

Focus on all key business concerns like economic, social, environmental

and governance. |

|

Commitment |

Organizations are more committed to social issues and responsibilities

towards society. |

Financial crises led the organizations to disclose more non-financial

information. |

|

Compliance |

Mandatory in India since 2013 and most the countries |

Voluntary practice in most of the counties and compulsory only few

countries. |

|

Capital |

Only social and relationship capital information is presented |

Present all six capitals with different trade-offs and interdependencies.

|

|

Connectivity |

Activities are connected to targeted stakeholders’ interest and limited

care towards society. |

Concerns more on stakeholders’ engagement and wider interest towards

society, environment, and all groups. |

|

Subject |

Explains job creation, donations, and other social activities that result

in a positive brand image. |

Explains key financial and non-financial parameters. |

|

Interlink |

No interlink with other information and provide less information on

externalities. |

IR substitutes CSR disclosure with financial matters and admit risk &

opportunities matters. |

|

Source Authors own compliance |

||

5.6. Theoretical Support

A sustainable IR gives a clear picture of value creation for every business enterprise in the short, medium, and long-term through the business model. So, the stakeholders can better understand the uses of IR framework. To support and implement IR in different parts of the world directly or indirectly few theories are backed to strengthen the IR Framework and adoption. A few notable theories are discussed like Agency, Stakeholders, Voluntary Disclosure, and Signalling theory.

5.6.1. Agency theory

It elucidates the connection between agent and principal. The agency bounding explains the contractual agreement between one party i.e., the principal who appoints another party i.e., the agent to act on behalf of the principal (Kılıc & Kuzey (2018)). The principal delegates some of his powers to agents for forward looking decisions (Suttipun (2017)). Some managers have better information than other users of the company (Islam (2021)). The diverge of interest evolves when the goals of the agent and principal are different. Due to opportunistic management behaviour and the presence of information irregularity, a conflict of interest arises (Jensen & Meckling (2019)). To solve this problem the agency theory suggests increasing the internal inspection system by appointing more independent directors or non-executive members and disclosing more IR information (Vitolla et al. (2020b)).

5.6.2. Stakeholders’ theory

This theory mainly focuses on the relationship between the organization and stakeholders (Adegboyegun et al. (2020)). Its mains focus on the relationship between the company and various stakeholders’ groups. It is a theory that replicates the company’s accountability towards stakeholders (Freeman & McVea (2005)). This theory may influence the external environment of the firm including customers, creditors, employees, traders, suppliers, credit providers and segments of the society. The best way to maintain the relationship with the stakeholders is to disclose both quantitative and qualitative information as per their need (Suttipun (2017)). The IR framework is intently linked to stakeholder groups, particularly the idea of value creation, which plays a vital role in promoting the sustainability of the company (Adegboyegun et al. (2020)).

5.6.3. Signalling Theory

This theory was used to examine or elucidate the information asymmetry and used to enumerate voluntary corporate sustainable information (Ebimobowei and Uche, 2021). Most of the companies indirectly pass signals to their interested stakeholders regarding disclosure of corporate information (Nurkumalasari et al. (2019)). The company offers information that is managed by top management, as a result, it is recognized by the public as minimizing cost related to information processing (Kaura et al., 2017). This is in accordance with signalling theory, which can significantly reduce information asymmetry (Nurkumalasari et al. (2019); Kilic and Kuzey, 2018). Signalling is a response to irregular data disclosure, in which capital providers lack information while companies have complete information (Watson et al. (2002)). According to the signalling theory “shareholders and management do not have access to the same corporate data” (Watson et al. (2002)). Similarly, the crucial information is well-known to the top management, but the investors may not be aware of important information (Kaura et al., 2017). Hence, the company passes the information through a selective insider, who is completely aware of the company’s information and divulges that information to external parties (Kılıc & Kuzey (2018)). It is anticipated that greater scope of disclosure provides more signalling information to external stakeholders and is expected to lower information asymmetry between business and stakeholder groups (Watson et al., 2002).

5.6.4. Voluntary disclosure theory

This theory recommends the value relevance of non-financial disclosure to the investors and to the capital providers (Dey (2020)). Few studies have enumerated the role of voluntary disclosure in enhancing sustainable disclosure and investor behaviour (Zhou et al., 2017). In addition to this, voluntary disclosure has a positive influence on the association between IR quality and firm value (Dey (2020)). Since, most companies across the globe follow IR adoption and disclosure in voluntary context except in South Africa but in a voluntary context only a few studies have examined the effect of IR and firm value (Dey (2020)). The voluntary adoption of IR aims to improve the corporate reporting practises, and sustainable reporting practise, which is more useful to the investors. Serafeim (2015) found a significant association between the voluntary adoption of IR and investors long-term shareholding position. Hence, in the studies under the voluntary disclosure context, the IR enhances the disclosure quality of sustainable information and removes information barriers.

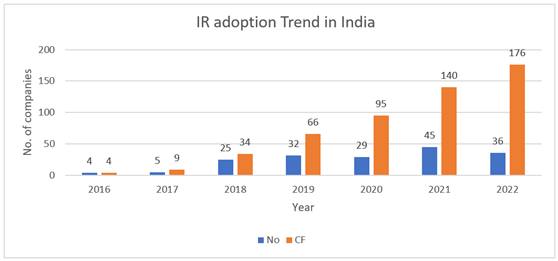

5.7. IR Adoption in India

A report from AICL (2020) presents that the current trend of IR adoption across the world, especially in India. This report highlights that at present IR adoption is followed by more than 2500 companies in 70 plus countries. However, the IR framework received a lower response from Indian companies but the adoption of IR is seemed to be improving by every passing year. The trend of IR adoption in India is presented in Figure 3. It is identified that only 176 companies adopted the IR practice by the financial year 2022 end. The financial year 2021 and 2022 disclosed highest individual IR adopted companies in India after SEBI circular 2021. However, the number of IR -adopting companies is increased but the percentage of implementing IR is not much improved. The Bombay Stock Exchange commonly known as BSE specifies that more than 4000 companies are actively traded by the year end 2022 (https:// www.bseindia .com/ corporates/ List Scrips.html). Out of these companies only a few listed companies which is less than 4.5% assumes to adopt the IR framework after the Securities and Exchange Board of India’s circular (SEBI) in 2017. Further, SEBI circular 2017 requested BSE’s top 500 listed companies to disclose the IR framework on a voluntary basis and requested the companies to incorporate a separate section on IR within the annual reports or disclose full-pledged integrated annual reports that cover all IR framework guidelines (SEBI (2017)). Similarly, the Confederation of Indian Industry (CII) in connotation with the IIRC has established an IR framework workplace (lab) to recommend IR adoption among Indian companies (Basu (2017); Soriya & Rastogi (2023). The SEBI (2021) circular notes that Business Responsibility and Sustainability Reporting (BRSR) shall be disclosed voluntarily by the BSE listed companies during the 2021-2022 financial year and mandatory disclose of BRSB from the financial year 2022 to 2023 for BSE top 1000 listed companies and disclose IR formation along with BRSB reports (SEBI (2021)).

Figure 3

|

Figure 3 IR Adoption Trends in India. Source: Annual Reports (No-Number of Companies, CF- Cumulative Frequency) |

5.8. Individual mean score of content elements (IR elements)

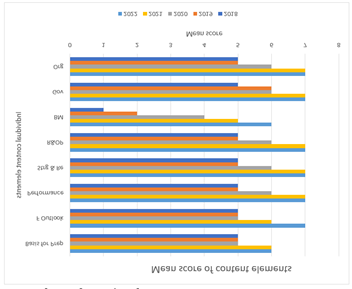

The Figure 4 describes five years of eight content elements. The mean score of organizational overview, governance, risk and opportunities, strategy and resource allocation, performance and outlook seem to be improved in 2022 compare to initial disclosure year. In contrast, business model mean score is very low compare to all other elements and companies are not up to the expectations of stakeholders in disclosing value creation model but its presentation in an annual report getting better. It is also observed that most of the companies do not prefer any special language, and did not avoid any generic disclosure that are quired by the organization, and stakeholder groups. Further, the disclosure levels of all elements are significantly improved from 2018 to 2022. Which indicates companies clearly enumerates the IR relevant information, and vital material factors. However, the study found most of the companies do not follow similar structure of IR disclosure practice, and their reporting structure significantly improve over the years. The other elements disclosure level is bit satisfactory. Finally, the overall IR elements improved significantly compared from 2018 to 2022.

Figure 4

|

Figure 4 Mean Trend of Individual IR Elements |

5.9. Mean score of IR index

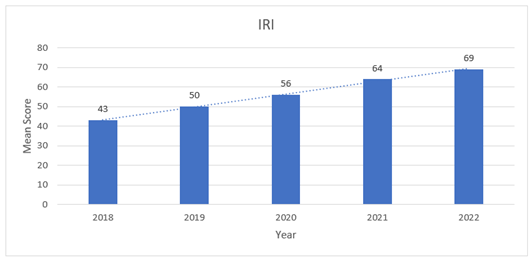

Figure 5 discloses the mean of IR index scores for five years. The mean score of IRI quality index is 43% in 2018, 50% in 2019, 56% in 2020, 64% in 2021, and 69% in 2022. The IR adoption in India was initiated by the SEBI’s circular in 2017, which encouraged Indian companies to publish IR information on voluntary basis. The disclosure quality of the sampled companies was satisfactory and improved through the period, even during the pandemic. It is observed that IRI mean score seems to be improved significantly compared from 2018 to 2022. The reason behind the improvement in IR trend is attributable to the SEBI circular in 2017 on voluntary disclose of IR information and requested all the firms to adopt this novel reporting style. It is observed that most of the IR adopted companies disclose information as per the IR framework requirements but their disclosure levels are not uniform. The pandemic had created several challenges like low level of economic growth, financial challenges, and reporting challenges. Further, according to stakeholders’ theory, companies are needed to communicate and maintain healthy association with stakeholder groups by proving high quality IR information, capital information, and meet various requirements in preparing IR information. The companies might have improved IR disclosure as a mechanism to overcome the pandemic effect and to remain close with the stakeholders by publishing material non-accounting information. Another reason could be gaining legitimacy image among various stakeholder groups, which results in improvement of IR trend.

Figure 5

|

Figure 5 Mean score of IR Index |

6. Conclusion

In this research, the study used conceptual, theoretical, content analysis and case study analysis to understand need of adoption of IR framework in Indian context. Substantial findings of this research can be elaborated in the following sentences. First in the voluntary contest of India, the practice of IR has added and received a significant attention from the sample of all IR adopted companies after the circulation of SEBIs in 2017 and made Indian companies to practice the globally accepted framework called IR. The case study of sample companies disclosed that IR framework used as a communication tool and enhanced association between stakeholder groups and management. Also, qualitative analysis disclosed that information asymmetry got reduced by the sample companies after the adoption of IR framework and communication mechanism much improved. Next, A manual content analysis is developed based on annual reports or integrated annual reports and named it as IR disclosure index. The percentage of mean score of IR Index has 43% in 2018, 50% in 2019, 56% in 2020, 64% in 2021, and 69% in 2022 respectively. The outcome revealed that disclosures for all content elements and materiality are significantly improves during the proposed period. Therefore, the entire conceptual papers enumerate IR is entirely different from other reports and can communicate value over various time frames.

6.1. Suggestions

The suggestions are pined based on the content analysis and case study analysis. Though, IR adoption is gaining popularity over the years globally but its adoption process is slow phase in India and Indian companies. This outcome may be due to lack of awareness on IR framework and value creation process and no clarity among the preparers between IR disclosure and non-financial reports of corporates. The findings clearly suggests that there is a complete requirement for the implementation of IR framework across all listed companies in India irrespective of their size and their profitability. The preparers and other regulatory bodies might consider this request and go further to endorse the IR framework. The research conclusions might useful to the stakeholders, investors, preparers, companies, and IIRC members. Hence, this study proposes the following valid suggestions.

1) The preparers, professional bodies and regulators must extend their support to have quality IR framework practice and meet the obligations of stakeholders in generating value to the firm. Also, the managers must consider need for disclosing both financial and non-financial information under a single document called IR framework.

2) Through content analysis and case study analysis could not justify the complete reporting mechanism. Its’ also suggest to have empirical justification to validate IR quality.

6.2. Limitations and Future research scope

The size of this study is limited to only 176 Indian listed companies with five years durations. This could be another scope to investigate empirically the association between IR quality and firm performance, and influence of board attributes on IR quality.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

AICL. (2020). India Adopts Integrated

Report/insights, Trends, and Best Practices. Pdf, assed on August, 10th,

2022.

Abeysekera, I. (2010). The Influence of Board Size on

Intellectual Capital Disclosure by Kenyan listed Firms. Journal of Intellectual

Capital, 11(4), 504-518. https://doi.org/10.1108/14691931011085650

Abhishek N, D., & Divyashree, M.S. (2019). Integrated Reporting Practices in Indian Companies. FOCUS: Journal of International Business, 6(1), 140-151. https://doi.org/10.17492/focus.v6i1.182825

Abhishek N, D., Ashok, M. L., Acharya, P., & MS, D. (2020). Integrated Reporting as a New Dimension of Corporate Reporting: an Indian perspective. Journal of Commerce & Accounting Research, 9(3), 63-73.

Adams, S., & Simnett, R. (2011). Integrated Reporting: An

Opportunity for Australia's not‐for‐profit sector. Australian

Accounting Review, 21(3), 292-301.

https://doi.org/10.1111/j.1835-2561.2011.00143.x

Adegboyegun, A.E., Alade, M.E., Ben-Caleb, E., Ademola, A.O., Eluyela, D.F. and Oladipo, O.A., (2020). Integrated Reporting and Corporate Performance in Nigeria: Evidence from the Banking Industry. Cogent Business & Management, 7(1), p.1736866. https://doi.org/10.1080/23311975.2020.1736866

Agustia, D., Sriani, D., Wicaksono, H., & Gani, L. (2020).

Integrated Reporting Quality Assessment. Journal of Security and Sustainability

Issues, 10(1), 47-59. https://doi.org/10.9770/jssi.2020.10.1(4)

Albetairi,

H. T. A., Kukreja, G., & Hamdan, A. (2018). Integrated Reporting and

Financial Performance: Empirical Evidences from Bahraini Listed Insurance

Companies. Accounting and Finance Research, 7(3), 102-110.

https://doi.org/10.5430/afr.v7n3p102

Ashok, M. L. (2019). Role of XBRL in

Promoting the Integrated Reporting in Indian Scenario. Indian Journal of

Accounting, 51 (1), 25-33.

Athma, P., & Rajyalaxmi, N. (2013). Integrated Reporting: The global Scenario. IUP Journal of Accounting Research & Audit Practices, 12(3), 7-18.

Bal. T, and Sunil, K. D (2020). Integrated Reporting: it's

Impact on value Creation. International journal of Resent Technology and

Engineering, 9(2), 1-5. https://doi.org/10.35940/ijrte.B3416.079220

Barth, M. E., Cahan, S. F., Chen, L., &

Venter, E. R. (2017). The Economic Consequences Associated with

Integrated Report Quality: Capital Market and Real Effects. Accounting,

Organizations and Society, 62, 43-64. https://doi.org/10.1016/j.aos.2017.08.005

Basu, A. (2017). Integrated Reporting: an Indian Perspective. International Journal of Business and Administration Research Review, 3(20), 77-82.

Cheng,

M., Green, W., Conradie, P., Konishi, N., & Romi, A. (2014). The

international Integrated Reporting Framework: key Issues and Future Research

Opportunities. Journal of International Financial Management & Accounting,

25(1), 90-119. https://doi.org/10.1111/jifm.12015

Cohen,

J. R., Holder-Webb, L. L., Nath, L., & Wood, D. (2012). Corporate

Reporting of Nonfinancial leading Indicators of Economic Performance and

Sustainability. Accounting Horizons, 26(1), 65-90.

https://doi.org/10.2308/acch-50073

De Villiers, C., & Sharma, U. (2020). A Critical Reflection

on the Future of Financial, Intellectual Capital, Sustainability, and

Integrated Reporting. Critical Perspectives on Accounting, 70, 101999.

https://doi.org/10.1016/j.cpa.2017.05.003

De

Villiers, C., Venter, E. R., & Hsiao, P. C. K. (2017). Integrated

Reporting: Background, Measurement Issues, Approaches, and an Agenda for Future

Research. Accounting & Finance, 57(4), 937-959.

https://doi.org/10.1111/acfi.12246

Dey, P. K. (2020). Value relevance of Integrated Reporting: A

Study of the Bangladesh Banking Sector. International Journal of Disclosure and

Governance, 17(4), 195-207. https://doi.org/10.1057/s41310-020-00084-z

Dragu, I. M., & Tiron-Tudor, A. (2013). The Integrated Reporting Initiative from an Institutional Perspective: Emergent Factors. Procedia-Social and Behavioral Sciences, 92, 275-279. https://doi.org/10.1016/j.sbspro.2013.08.672

Dube, V. (2018). The Association Between Integrated Reporting and Company Financial Performance: A Graphical Time-Series Approach (Doctoral Dissertation, University of Pretoria).

Dumay, J., Bernardi, C., Guthrie, J., & La Torre, M. (2017).

Barriers to Implementing the International Integrated Reporting Framework: A

contemporary Academic Perspective. Meditari Accountancy Research, 25(4),

461-480. https://doi.org/10.1108/MEDAR-05-2017-0150

EY (2012). Value of Sustainability

Reporting.

Ebimobowei,

A., & Uche, O. J. (2021). Integrated Reporting Disclosures and Firm

Value of Listed Insurance Companies in Nigeria. African Journal of Accounting

and Financial Research, 4(2), 55-76. https://doi.org/10.52589/AJAFR-WQIAKPZY

Eccles, R. G., & Krzus, M. P. (2010).

One Report: Integrated Reporting for a Sustainable Strategy. John Wiley &

Sons.

Eccles, R. G., & Saltzman, D. (2011). Achieving Sustainability Through Integrated Reporting. Stanford Social Innovation Review, 9(3), 56-61.

Eccles, R. G., Krzus, M. P., & Ribot, S. (2015). Meaning and Momentum in the Integrated Reporting Movement. Journal of Applied Corporate Finance, 27(2), 8-17. https://doi.org/10.1111/jacf.12113

Flower, J. (2015). The International Integrated Reporting

Council: a Story of Failure. Critical Perspectives on Accounting, 27, 1-17.

https://doi.org/10.1016/j.cpa.2014.07.002

Freeman, R. E., & McVea, J. (2005). A Stakeholder Approach to Strategic Management. The Blackwell Handbook of Strategic Management, 183-201. https://doi.org/10.1111/b.9780631218616.2006.00007.x

Frias-Aceituno, J. V., Rodríguez-Ariza, L., & García-Sánchez, I. M. (2013). Is Integrated Reporting Determined by a Country's Legal System? An Exploratory Study. Journal of Cleaner Production, 44, 45-55. https://doi.org/10.1016/j.jclepro.2012.12.006

GRI. (2013) G4 Sustainability Reporting Guidelines. Assed on November, 25th, 2021.

Gleeson-White, J. (2014). Six capitals: The Revolution has to have - Or can Accountants save the Planet? Sydney: Allen & Unwin

Grant, T. B., (2020). Integrated Reporting in India - Survey on Adoption and the way Forward Integrated Reporting. , assed on August, 10th, 2022.

Gray, R. (2006). Social, Environmental and

Sustainability Reporting and Organizational value Creation? Whose value? Whose

creation? Accounting, Auditing& Accountability Journal, 19(6), 793-819.

https://doi.org/10.1108/09513570610709872

Haji, A. A., & Hossain, D. M. (2016). Exploring the Implications of Integrated Reporting on Organisational Reporting Practice: Evidence from Highly Regarded Integrated Reporters. Qualitative Research in Accounting & Management, 13(4), 415-444. https://doi.org/10.1108/QRAM-07-2015-0065

Hammond, K., & Miles, S. (2004). Assessing Quality

Assessment of Corporate Social Reporting: UK perspectives. In Accounting Forum,

28(1), 61-79. https://doi.org/10.1016/j.accfor.2004.04.005

Hoque, M. E. (2017). Why Company should Adopt Integrated Reporting? International Journal of Economics and Financial Issues, 7(1), 241-248.

Hossain,

D. A. (2021). Integrated Reporting: Evidence from Developed, Developing

and an Emerging Economy. Available at SSRN: https://doi.org/10.2139/ssrn.3785764

IIRC. (2011). Towards Integrated Reports-

Communicating value in the 21st Century. Framework Development: <IR>

Discussion paper. Retrieved from https://www.Integr atedrep

orting.org/wp-content /uploads/2011/09/IR-Discussion-Paper-2011_spreads.P df

Assessed on June, 201st, 2023.

IIRC. (2013). The International <IR> Framework. Retrieved from https://

apesb.org.au/wpcontent/uploads/meeting/board_meeting/21112014033402_Attachment_15_(c)_Consultation-Draft-of-the-

InternationalIRFramework.pdf, assed on August, 10th, 2022.

Institute of Directors of South Africa. (2009). King Report on Governance for South Africa - 2009. Pretoria: Institute of Directors of South Africa.

Iredele, O. O. (2019). Examining the Association Between Quality of Integrated Reports and Corporate Characteristics. Heliyon, 5(7), e01932. https://doi.org/10.1016/j.heliyon.2019.e01932

Islam, M. S. (2021). Investigating the Relationship Between Integrated Reporting and Firm Performance in a Voluntary Disclosure Regime: Insights from Bangladesh. Asian Journal of Accounting Research, 6(2), 228-245. https://doi.org/10.1108/AJAR-06-2020-0039

Jensen,

J. C., & Berg, N. (2012). Determinants of Traditional Sustainability

Reporting Versus Integrated Reporting. An Institutionalist Approach. Business

Strategy and the Environment, 21(5), 299-316. https://doi.org/10.1002/bse.740

Jensen, M. C., & Meckling, W. H. (2019). Theory of the firm: Managerial Behavior, Agency Costs and Ownership Structure. In Corporate governance, 3, 77-132.

Jhunjhunwala, S. (2014). Beyond Financial Reporting-International Integrated Reporting Framework. Indian Journal of Corporate Governance, 7(1), 73-80. https://doi.org/10.1177/0974686220140105

Kaura, A. A., Bello, A., & Sokoto, S. S. (2021).

Integrated Reporting and Firms' Performance of Listed ICT Companies in Nigeria.

Research square, 1-15. https://doi.org/10.21203/rs.3.rs-900392/v1

Krzus, M. P. (2011). Integrated reporting: if not now, when. Zeitschrift für internationale Rechnungslegung, 6(6), 271-276.

Kılıc,

M., & Kuzey, C. (2018). Determinants of forward-looking Disclosures

in Integrated Reporting. Managerial Auditing Journal, 33(1), 115-144. https://doi.org/10.1108/MAJ-12-2016-1498

Lai, A., Melloni, G., & Stacchezzini, R. (2018). Integrated Reporting and Narrative Accountability: the Role of Preparers. Accounting, Auditing & Accountability Journal, 31(5), 1381-1405. https://doi.org/10.1108/AAAJ-08-2016-2674

Lee, K. W., & Yeo, G. H. H. (2016). The Association Between Integrated Reporting and Firm Valuation. Review of Quantitative Finance and Accounting, 47(4), 1221-1250. https://doi.org/10.1007/s11156-015-0536-y

Lopes, A. I., & Braz, M. J. (2020). Integrated Reports

and Board Diversity: An International Perspective. In Conceptual and

Theoretical Approaches to Corporate Social Responsibility, Entrepreneurial

Orientation, and Financial Performance. IGI Global, 152-170. https://doi.org/10.4018/978-1-7998-2128-1.ch008

Maroun, W. (2019). Does External Assurance Contribute to Higher Quality Integrated Reports? Journal of Accounting and Public Policy, 38(4), 1-6. https://doi.org/10.1016/j.jaccpubpol.2019.06.002

Misra, N., & Agarwal, R.

(2011). Corporate Social Reporting: An Analysis of

Current Reporting. In International Conference on Advancements in Information

Technology with Workshop of ICBMG, 249-253.

Nurkumalasari, I. S.,

Restuningdiah, N., & Sidharta, E. A. (2019).

Integrated Reporting Disclosure and its Impact on Firm Value: Evidence in Asia.

International Journal of Business, Economics and Law, 18(5), 99-108.

Owen, G. (2015). Integrated Reporting: A Review of Developments and their Implications

for the Accounting Curriculum. Sustainability in Accounting Education, 43-59.

Prajapati, M. R., Shibin, T.

S., & Lad, Y. A. (2014). Integrated Reporting:

A One Step Ahead Towards Corporate Reporting. Journal of Radix International

Education and Research Consortium, 3(10), 1-4.

SEBI (2017). Integrated Reporting by Listed Entities, Securities and Exchange Board of India.

SEBI (2021). SEBI issues Circular on Business Responsibility and Sustainability Reporting by listed entities.

Serafeim,

G. (2015). Integrated Reporting and Investor Clientele. Journal of

Applied Corporate Finance, 27(2), 34-51. https://doi.org/10.1111/jacf.12116

https://dx.doi.org/10.29121/ShodhPrabandhan.v1.i1.2024.7

Simnett, R., & Huggins, A. L. (2015). Integrated

Reporting and aSsurance: Where can Research add value? Sustainability

Accounting, Management and Policy Journal, 6(1), 29-53. https://doi.org/10.1108/SAMPJ-09-2014-0053

Singh, H. K., Saurabh, S., & Singh, V (2019). Impact of Board of Directors on NIFTY 50 Listed Companies in India. The Orissa Journal of Commerce Association, 20(3), 1-12.

Sofian,

I., & Dumitru, M. (2017). The compliance of the Integrated Reports

Issued by European Financial Companies with the International Integrated

Reporting Framework. Sustainability, 9(8), 1319. https://doi.org/10.3390/su9081319

Soriya, S., & Rastogi, P. (2023). The Impact of Integrated Reporting on Financial Performance in India: a panel data analysis. Journal of Applied Accounting Research, 24(1), 199-216. https://doi.org/10.1108/JAAR-10-2021-0271

Sun, B. (2012). Understanding Transformation: Building the Business Case for Integrated Reporting, International Integrated Reporting Council, London.

Suttipun,

M. (2017). The Effect of Integrated Reporting on Corporate Financial

Performance: Evidence from Thailand. Corporate Ownership and Control, 15(1),

133-142. https://doi.org/10.22495/cocv15i1art13

Terblanche,

W., & De Villiers, C. (2018). The Influence of Integrated Reporting

and Internationalisation on Intellectual Capital Disclosures. Journal of

Intellectual Capital, 20(1), 40-59. https://doi.org/10.1108/JIC-03-2018-0059

Vitolla, F., & Raimo, N. (2018). Adoption of Integrated Reporting: Reasons and Benefits-A Case Study analysis. International Journal of Business and Management, 13(12), 244-250. https://doi.org/10.5539/ijbm.v13n12p244

Vitolla,

F., Raimo, N., & Rubino, M. (2020a). Board Characteristics and

Integrated Reporting Quality: An Agency Theory Perspective. Corporate Social

Responsibility and Environmental Management, 27(2), 1152-1163. https://doi.org/10.1002/csr.1879

Vitolla, F., Raimo, N., Marrone, A., & Rubino, M. (2020b). The Role of Board of Directors in Intellectual Capital Disclosure After the Advent of Integrated Reporting. Corporate Social Responsibility and Environmental Management, 27(5), 2188-2200. https://doi.org/10.1002/csr.1957

Vitolla,

F., Raimo, N., Rubino, M., & Garzoni, A. (2020c). The Determinants

of Integrated Reporting Quality in Financial Institutions. Corporate

Governance: The International Journal of Business in Society, 20(3), 429-444. https://doi.org/10.1108/CG-07-2019-0202

Vrushali, G., (2019). IIRC: Integrated Reporting in India. Retrieved from https: //www. Integra tedreporting.org/news/integrated-reporting-in-india-2019/, assed on August, 10th, 2022.

Watson,

A., Shrives, P., & Marston, C. (2002). Voluntary Disclosure of

Accounting Ratios in the UK. The British Accounting Review, 34(4), 289-313. https://doi.org/10.1006/bare.2002.0213

Weybrecht, G. (2010). The Sustainable MBA: The Manager's Guide to Green Business. John Wiley & Sons.

Zhou, S., Simnett, R., & Green,

W. (2017). Does integrated Reporting Matter to the

Capital Market? Abacus, 53(1), 94-132. https://doi.org/10.1111/abac.12104

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhPrabandhan 2024. All Rights Reserved.