|

|

|

|

|

Accounting Practices and Small Business Sustainability: A Comparative Study of India and Oman

Nandini Ashokkumar Modha 1![]() , Dr. Deepa Damodaran 2

, Dr. Deepa Damodaran 2![]() , Dr. Bhawna Sharma 3

, Dr. Bhawna Sharma 3![]()

1 Bcom

(Accounting and Finance) Student, Amity Business School, Amity University Mumbai,

Mumbai, Maharashtra, India

2 Associate

Professor, Amity Business School, Amity University Mumbai, Mumbai, Maharashtra,

India

3 Officiating HOI, Amity Business School, Amity University Mumbai,

Mumbai, Maharashtra, India

|

|

ABSTRACT |

||

|

Small

businesses form the backbone of most economies, making significant

contributions to employment and innovation. However, their survival often

depends on effective financial management. This paper examines the crucial

role of accounting in promoting small business success, concentrating on how

accurate record-keeping, financial reporting, and compliance practices

facilitate informed decision-making and long-term sustainability. Drawing on

comparative insights from India and Oman, as well as practical observations

from an internship experience, the study highlights the benefits of

structured accounting systems and the challenges faced by small enterprises

in adopting them. The analysis emphasizes that accounting is not merely a

technical requirement but a strategic tool that enhances credibility,

improves cash flow management, and enables growth. The findings suggest that

greater awareness, affordable digital tools, and training can strengthen

accounting practices in small businesses, ultimately contributing to their

long‑term viability. |

|||

|

Received 28 April 2025 Accepted 29 May 2025 Published 30 June 2025 Corresponding Author Nandini

Ashokkumar Modha, nandinimodha1@gmail.com DOI 10.29121/ShodhPrabandhan.v2.i1.2025.46 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Accounting, Small Business, India and Oman, Sustainability |

|||

1. INTRODUCTION

Small businesses are promoted as the backbone of national economies since they help in generating employment, fostering innovation, and local development. In countries such as India and Oman, SMEs are considered key players in sustaining livelihoods and driving the pace of economic growth. In spite of their importance, numerous small-scale businesses fail to survive or expand operations due to inefficient financial management.

Accounting, many would call the "language of business," provides the guidelines on recording, analysis, and communication of financial information. In small businesses, good accounting practices are usually not merely technical but also an important tool in decision-making, compliance, and long-term viability. Proper bookkeeping can allow owners to track their income and expenses, evaluate the profitability of their businesses, and set a course for future growth. Additionally, transparent financial records build credibility with banks, investors, and regulatory bodies, thus opening possible opportunities for funding and expansion.

In these cases, small businesses often face resource constraints, an absence of skilled personnel, or dependence on informal mechanisms of keeping records. All these factors together may result in poor cash flow management, tax complications, and finally, business failure. In this paper, the role of accounting in ensuring the success of a small business is discussed to identify its benefits and barriers. Comparative insights from India and Oman, supplemented by practical observations from internship experience, highlight the importance of a structured accounting system in ensuring the survival and growth of small enterprises.

2. Literature Review

1) Accounting

as the Backbone of Business

It has been termed the "language of business" in many texts since it communicates financial information to stakeholders. Accurate bookkeeping can allow the proprietors of small businesses to comprehend their financial situation and make intelligent decisions that ensure further growth and expansion. In reality, most SMEs do not see the end of their first year without structured accounts.

2) Small

Business Vulnerabilities

The particular issues faced by small businesses differ from those of large enterprises. Limited resources, informal management practices, and lack of professional expertise generally result in weak financial systems. Local studies show that a large number of Indian SMEs maintain either manual records or no records at all, which increases the propensity for errors and fraud. In Oman, attitudes toward trust and relationships sometimes reduce emphasis on formal accounting, though globalization is pushing firms toward structured systems.

3) Benefits

of Proper Accounting Practices

Research has shown that accounting enhances:

· Cash flow management: Ensuring businesses are capable of meeting their short-term obligations.

· Decision-making: Assisting owners in decisions concerning profitability and investment opportunities.

· Compliance: Achieving tax and regulatory requirements.

· Credibility: Gaining confidence with banks, investors, and suppliers.

· For instance, Indian SMEs adopting digital accounting tools like Tally or Zoho Books manifest efficiency and a reduction in tax-related issues. In Oman, small trading firms reported an improvement in their relationships with suppliers and smoother operations after the implementation of structured accounting systems.

4) Comparative

Insights: India and Oman

It is expected that cross-cultural studies would indicate that though both countries favor small businesses, their approach towards accounting is different. India has a fast-growing ecosystem of affordable digital tools and government initiatives aimed at financial literacy. Oman, though guided by international standards and trade, focuses on compliance with IFRS; however, challenges are found in the training and awareness for smaller firms.

5) Emerging

Trends in SME Accounting

Recent literature highlights the emergence of digitalization, cloud-based accounting, and AI-driven tools. Most of these innovations are cost-effective; hence, they make accountancy more accessible to small entities. These authors indicate that technology might fill the gap between informal practices and structured systems, particularly in developing economies.

3. Importance of Accounting in Small Businesses

Accounting plays a critical role in the success and sustainability of small businesses by offering the following:

· Financial clarity: Accurate records help owners to distinguish between profit and loss and enable them to plan accordingly.

· Decision-making: Accounting data reinforces pricing, investment, and expansion.

· Compliance assurance: Accurate books ensure the fulfillment of tax obligations and legal requirements to avoid penalties.

· Enhanced Credibility: Accounts as transparent as this build confidence among banks, investors, and suppliers and are very helpful for credit availability and partnerships.

· Cash Flow Management: This involves monitoring inflows and outflows to ensure liquidity and operational stability.

· Strategic planning: Financial reporting allows one to forecast the business and long-term growth.

So, effective accounting is the foundation of a small business' resiliency and growth.

4. Challenges Faced by Small Businesses

Small businesses face various accounting challenges that limit their potential for growth and continuity. Some of these include:

• Lack of trained accountants or financial literacy: Most small business owners have never had formal training in accounting. Therefore, mistakes and mismanagement abound.

• Reliance on informal or manual record-keeping: Manual bookkeeping is very prone to mistakes, loss of data, and inefficiency.

• High accounting software cost for micro-enterprises: Very small businesses may find the licensing of the software too expensive.

• Cultural attitudes that undervalue the place of a structured financial system: informal trust-based transactions reduce perceived needs for formal accounting.

• Cash flow management challenges: Inconsistent income and expenses complicate the process of maintaining liquidity.

• Tax compliance: Complexity in compliance, requiring expert help to navigate through tax laws and filing.

• Resistance towards adapting to new technologies: Companies are often reluctant to shift from traditional ways to digital tools.

Addressing these challenges requires targeted interventions such as financial literacy programs, affordable digital solutions, and supportive policies.

5. Findings

The survey was conducted among 20 respondents, including finance interns, students, and professionals. The aim was to assess awareness of accounting standards, reporting frequency, cultural influence, and the impact of technology on financial reporting.

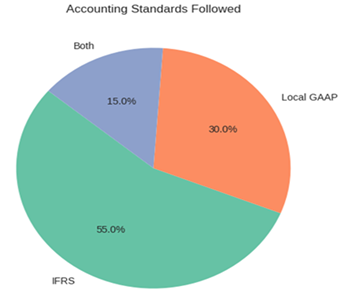

1) Which

accounting standards do you primarily follow?

Responses (20):

· IFRS: 55%

· Local GAAP: 30%

· Both: 15%

Analysis:

The majority of respondents (55%) follow IFRS, indicating a strong alignment

with international standards. However, 30% still rely on local GAAP, suggesting

regional practices remain influential. A small group (15%) uses both,

reflecting hybrid compliance strategies.

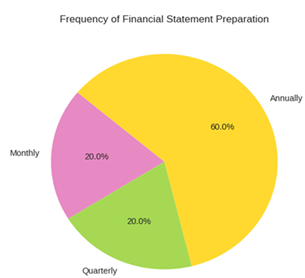

2) How

often are financial statements prepared for external stakeholders?

Responses (20):

· Monthly: 20%

· Quarterly: 20%

· Annually: 60%

Analysis:

A clear majority (60%) prepare statements annually, which may reflect traditional reporting cycles. Monthly and quarterly reporting are less common, possibly due to resource constraints or organizational norms.

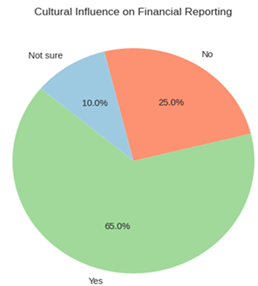

3)

Do cultural values influence financial

reporting in your organization?

Responses (20):

· Yes: 65%

· No: 25%

· Not sure: 10%

Analysis:

Most respondents (65%) believe cultural values do influence reporting, supporting the idea that financial practices are shaped by regional norms and expectations. This insight is crucial for cross-cultural financial analysis

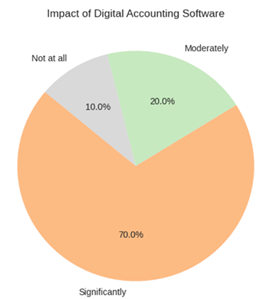

4) Has

digital accounting software changed reporting style in the past 5 years?

Responses (20):

· Significantly: 70%

· Moderately: 20%

· Not at all: 10%

Analysis:

A strong majority (70%) reported significant changes due to digital tools, indicating that technology is a key driver of modernization in financial reporting. This supports the need for tech-focused training and system upgrades.

6. Case Study

6.1. Internship Experience at Rashad Establishment, Oman

My one-month internship at Rashad Establishment, a small trading firm in Muscat, acquainted me with the importance of systematic accounting in the firm's daily activities. This small enterprise efficiently recorded every transaction with suppliers, payments to and from customers, and inventory management. This orderly way of conducting business allowed for timely payment, minimal disputes with suppliers, and better supplier relations. Indeed, the experience showed that even the smallest firms benefit by disciplined accounting in order to survive and command respect.

6.2. Adoption of Digital Accounting Tools in Indian SMEs

Most small businesses today use some form of digital accounting software like Tally and Zoho Books to simplify bookkeeping, automate tax calculations, and generate financial reports that reduce errors and save time. For instance, a local textile SME reported a 30% reduction in tax filing errors and faster invoice processing after adopting Tally. This shift not only improved operational efficiency but also enhanced credibility with banks and investors, thus facilitating access to credit.

6.3. Cultural Impact on Accounting Practices in Oman

Oman's accounting adoption is influenced by cultural factors among small-scale businesses. Trust-based relationships result in informal credit and less need for formal records. Globalization and regulatory pressures argue for increasing firm adoption of International Financial Reporting Standards (IFRS). Small-scale enterprises are constrained to increase training and awareness, although they perceive the latter long-term benefits in terms of growth and international trade.

6.4. Common Challenges and Solutions

The challenges facing small businesses in both countries include a lack of financial literacy, high costs of software, and resistance to change. This requires government-led programs on financial literacy, cloud-based accounting at affordable costs, and community workshops. For example, an initiative by the Indian government provides subsidized access to accounting software and training for micro-enterprises to transition from manual systems to digital ones

7. Discussion

The findings from the questionnaire and the case study together provide a comprehensive understanding of how accounting practices shape small business sustainability in India and Oman.

1) Alignment of Survey and Case Study Results

· The survey revealed that 55% of respondents follow IFRS, while 30% rely on local GAAP. This aligns with internship observations in Oman, where local GAAP was dominant, but awareness of IFRS was growing.

· 65% of respondents agreed that cultural values influence reporting, which is consistent with the Omani case study, where trust-based relationships often reduced emphasis on formal record-keeping.

· The survey showed that 70% of respondents experienced significant changes due to digital accounting software, reflecting the Indian SME case study where tools like Tally and Zoho Books reduced errors and improved efficiency.

2) Comparative Insights

· In India, transparency and digital adoption are emphasized, with SMEs leveraging technology to enhance credibility and access to credit.

· In Oman, confidentiality and compliance dominate, with gradual movement toward IFRS adoption influenced by globalization and regulatory requirements.

· These differences highlight the role of culture and regulation in shaping accounting practices, even when businesses face similar challenges such as limited resources and resistance to change.

3) Implications for Small Businesses

· The integration of structured accounting systems is critical for both contexts, but the path differs: India through digital innovation, Oman through regulatory compliance.

· Training and awareness programs are essential to bridge knowledge gaps, as shown by the survey responses where a significant proportion of employees were unfamiliar with or neutral about budgeting processes.

· Affordable technology solutions can accelerate adoption, particularly in resource-constrained SMEs.

8. Conclusion

This paper aimed to examine the role of accounting in the success and sustainability of small business enterprises, focusing on comparative practices between India and Oman. Combining survey findings with internship observations and secondary insights provided for a balanced view regarding how accounting systems are adopted, understood, and applied in different cultural and economic contexts.

The results of the survey highlighted a number of important trends. The majority of respondents rely on international standards such as IFRS, reflecting the growing influence of globalization and regulatory requirements. However, there was also a significant proportion depending on local GAAP, showing how deeply embedded regional practices remain. The responses also underlined that cultural values are strongly prevalent in shaping financial reporting, and many participants acknowledged that traditions and attitudes influence how transparency and confidentiality are balanced. Moreover, the impact of digital accounting tools was clear, with most respondents acknowledging significant changes in reporting styles over the last five years. This suggests that technology is making accounting not only more modern but also increasingly open to smaller enterprises.

The case study gave qualitative depth to these findings. The internship experience at Rashad Establishment in Oman demonstrated how even small firms benefit from systematic record keeping, which supports timely payments, reduces disputes, and strengthens supplier relationships. On the other hand, the SMEs in India were able to showcase the transformational power of digital tools like Tally and Zoho Books, which minimize errors and automate tax processes while enhancing trust with banking and investment agencies. These examples have underlined the fact that though the challenges to small businesses both in these countries are similar-lack of financial literacy, constraint of resources, and reluctance toward change-the solutions often differ. India's strength is rapid adaptation to affordable digital tools, while Oman's focus has been on ensuring compliance with, and gradual alignment of, accounting practices to international standards.

Combined, the evidence suggests that accounting is much more than a technical requirement; rather, it serves to build trust, inform decisions, and provide avenues for expansion. For small businesses, structured accounting systems provide clarity in financial management, ensure compliance with relevant regulations, and create avenues for expansion through gains in credibility from external entities. Comparative insight into India and Oman offers an important reflection of how accounting practices are also shaped by cultural values and regulatory frameworks beyond mere economic need.

The key implication of the present study is that strengthening accounting practices is indispensable for the resilience and long-term viability of small enterprises. Whether through the systematization of record keeping in Oman or the use of digital innovations in India, structured financial systems have been found to support the sustainability, credibility, and growth of businesses. Knowledge of challenges at the micro and small enterprise level and evolving practices across different contexts can help their positioning in an increasingly competitive and globalized economy.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

AI Accountant. (2025, November 19). 15 Best Accounting Software for Small Businesses in India (free and paid).

HisabKitab. (2023). Top 10 Accounting Automation Tools for Indian SMEs.

IFRS Foundation. (2025). Jurisdiction Profile : Oman.

Ministry of Micro, Small and Medium Enterprises, Government of India. (2022). Annual report 2021–22.

Oman Observer. (2025). FSA Adopts Simplified IFRS Standards for Smes in Oman. Oman Observer.

Thottoli, M. M. (2020). Impact of Accounting Software Among SMEs Accountants in Oman. Financial Markets, Institutions and Risks, 4(2), 25–33. https://doi.org/10.21272/fmir.4(2).25-33.2020

Thottoli, M. M., and Ahmed, E. R. (2021). Information Technology and E-Accounting: Some Determinants Among SMEs in Oman. Journal of Money and Business, 2(1), 1–15. https://doi.org/10.1108/JMB-05-2021-0018

The Arabian Stories. (2025, February 17). FSA Implements IFRS for Financial Reporting in Oman, SMEs to use Simplified Standards. The Arabian Stories.

Vishwa, K., and Harsha. (2024). A Study of Accounting Practices in Micro, Small and Medium Enterprises (MSMEs). Journal of Emerging Technologies and Innovative Research, 11(5).

VyaaparKhata. (2025, October 15). Top 10 Accounting Apps for Indian SMEs.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhPrabandhan 2025. All Rights Reserved.