|

|

|

|

|

Addressing the Naira's Free-fall in the Wake of Energy Subsidy Removal: A Policy Roadmap for Nigeria's Democracy

Ahmad, Muhammad Makarfi 1![]() ,

Sadiq Mohammed Sanusi 2

,

Sadiq Mohammed Sanusi 2![]()

![]()

1 Department

of Agricultural Economics and Extension, BUK, Kano, Nigeria

2 Department

of Agricultural Economics and Agribusiness, FUD, Dutse, Nigeria

|

|

ABSTRACT |

||

|

This research

review paper explores the complex relationship between the removal of energy

subsidies and the depreciation of the Nigerian naira under the current

democratic government. Energy subsidies have long been a point of contention

in Nigeria, with successive governments grappling with the economic, social,

and political implications of their removal. The removal of energy subsidies

has been touted as a necessary measure to free up government revenue for

development projects, but it has also triggered inflation, social unrest, and

a free fall of the naira in the foreign exchange market. This review paper

examines the historical context of energy subsidies in Nigeria, their impact

on the economy, and the theoretical and conceptual frameworks that explain

the interaction between subsidy removal and currency depreciation. It also

delves into the current administration’s policies on subsidy removal, the

challenges posed by the free fall of the naira, and potential strategies for

mitigating these issues. The paper concludes with recommendations for

sustainable economic reform, focusing on balancing fiscal responsibility with

social equity in a democratic context. |

|||

|

Received 16 November 2024 Accepted 30 December 2024 Published 31 January 2025 Corresponding Author Sadiq,

Mohammed Sanusi, sadiqsanusi30@gmail.com DOI 10.29121/ShodhPrabandhan.v2.i1.2025.15 Funding: This research

received no specific grant from any funding agency in the public, commercial,

or not-for-profit sectors. Copyright: © 2025 The

Author(s). This work is licensed under a Creative Commons

Attribution 4.0 International License. With the

license CC-BY, authors retain the copyright, allowing anyone to download,

reuse, re-print, modify, distribute, and/or copy their contribution. The work

must be properly attributed to its author.

|

|||

|

Keywords: Currency, Devaluation, Energy, Economy, Subsidy

Removal, Nigeria |

|||

1. INTRODUCTION

Energy subsidies

in Nigeria have been a contentious issue for decades, deeply entrenched in the

socio-economic fabric of the country Jesuola (2024). Introduced initially to alleviate the

burden of high energy costs on consumers and protect the poor, these subsidies

have since become a drain on the national budget Mbanefo (2024). According to the Nigerian National

Petroleum Corporation (NNPC), subsidies cost the government billions of dollars

annually, diverting funds that could be used for critical infrastructure

development, healthcare, and education Fyneroad, (2024).

The debate over

whether to remove energy subsidies has been reignited under the current

democratic government, particularly in the context of Nigeria's deteriorating

fiscal position and the free fall of the naira. The naira, Nigeria’s official

currency, has experienced significant depreciation over the past few years,

driven by several factors, including low oil prices, dwindling foreign

reserves, and economic mismanagement. The removal of energy subsidies is seen

by many as a necessary step to stabilize the economy, but it has also led to

increased inflation, higher living costs, and widespread public discontent.

The issue

of energy subsidies

in Nigeria remains a highly polarizing topic, with deep implications for the

country's economic stability, social welfare, and political landscape.

Initially introduced to make energy more affordable for Nigerians, particularly

the poor, these subsidies have become a fiscal

burden that consumes a substantial portion of the national

budget Nigerian

National Petroleum Corporation (NNPC) (2023). The Nigerian government spends billions annually

to keep fuel prices artificially low, even as the country faces pressing

challenges such as decaying infrastructure, underfunded healthcare systems, and

inadequate educational services Ogundele and Ibrahim (2024).

In recent

years, the debate over the removal

of energy subsidies has gained momentum, largely due to

Nigeria's deteriorating fiscal

position and the weakening of the naira. The cost of

maintaining subsidies has escalated with the global rise in oil prices, further

straining government finances. According to some analysts, Nigeria is spending

as much on fuel subsidies as it is earning from crude oil exports, leading to a

fiscal imbalance

that threatens the country’s economic sustainability Adewale and Yusuf (2023).

The

Nigerian government’s democratic

administrations have repeatedly attempted to remove these

subsidies, viewing it as a necessary measure to reduce the fiscal deficit and

ensure long-term economic stability. In particular, President Bola Tinubu’s

administration has taken steps toward subsidy

removal, citing the urgent need to free up resources for

infrastructure development and social services Akinola (2023). However, these moves have consistently been met

with widespread public

opposition, as fuel price increases lead to higher inflation, rising living

costs, and a disproportionate impact on low-income households Adamu

and Hassan (2024)

The removal

of energy subsidies has macroeconomic

implications for Nigeria. On one hand, it is seen as a way to

reduce economic distortions,

encourage investment in the energy sector, and address the inefficiencies

caused by subsidized fuel prices, which often lead to smuggling and market

distortions Usman

and Garba (2023). Additionally,

it could help curb the large-scale corruption that has historically plagued the

subsidy system, where billions of dollars were reportedly siphoned off through

fraudulent claims by oil marketers Bello

and Musa (2023).

On the

other hand, the immediate effects of subsidy removal are often felt by ordinary citizens, as the

increase in fuel prices leads to higher transportation costs, which ripple

through the economy, affecting the prices of goods and services Ogunleye

and Salisu (2023). For a country where a significant portion of the

population lives below the poverty line, these price hikes exacerbate economic inequality and fuel

social unrest. The Nigerian Labour Congress (NLC) and other civil society

groups have been vocal in their opposition, arguing that without adequate social safety nets, removing

subsidies will disproportionately harm the most vulnerable populations Idris

and Lawal (2024).

The depreciation of the naira has

further complicated the debate. The weakening of Nigeria’s currency, driven by

a combination of low oil prices, dwindling foreign reserves, and macroeconomic

mismanagement, has increased the cost of imported goods and services, further

fueling inflation Olawale and Ajiboye (2023). As the cost of living rises, public tolerance for

subsidy removal diminishes, placing the government in a difficult position of

balancing fiscal responsibility with social stability.

This paper aims

to explore the intersection of energy subsidy removal and the free fall of the

naira, providing a comprehensive analysis of the economic and political factors

at play. The review will also highlight the potential way forward for Nigeria, focusing

on the role of the current democratic government in managing the delicate

balance between fiscal austerity and social welfare. Consequently, the specific

objectives are as follows:

1)

To

assess the historical context of energy subsidies in Nigeria.

2)

To

assess the impact of subsidy removal on the economy.

3)

To

assess the role of the democratic government.

4)

To

highlight the potential way forward.

2. Theoretical Framework

To understand the

implications of energy subsidy removal and the depreciation of the naira, it is

essential to ground the analysis in relevant economic theories. Two key

theories provide the foundation for this discussion: the theory of subsidies

and the theory of exchange rates.

1)

Theory

of subsidies

The economic

theory of subsidies suggests that government intervention in the form of

financial aid to producers or consumers is intended to lower the cost of goods

or services Sambo

and Sule (2024). In the context of energy subsidies,

governments typically provide financial support to energy companies, allowing

them to offer products like fuel or electricity at below-market prices. This

intervention is often justified by the need to ensure affordability for the

population Chukwunonso

et al. (2024), particularly in developing economies where

energy poverty is prevalent.

However,

subsidies can lead to inefficiencies in the market by distorting price signals.

In the case of Nigeria, the government’s long-standing fuel subsidy program has

led to a situation where energy prices do not reflect the true cost of

production, leading to overconsumption, inefficiency, and waste. Furthermore,

subsidies represent a significant fiscal burden on the government, diverting

resources away from other critical areas of the economy. The removal of

subsidies is thus seen as a necessary corrective measure to restore market

efficiency and reduce fiscal deficits.

2)

Theory

of exchange rates

The theory of

exchange rates is central to understanding the depreciation of the naira in the

context of subsidy removal. According to the Purchasing Power Parity (PPP)

theory, exchange rates between two countries should adjust to reflect changes

in price levels, with currencies of countries experiencing inflation

depreciating relative to others Ogunmokun

(2024). Nigeria’s overreliance on oil exports and

the mismanagement of foreign exchange reserves have contributed to a decline in

the value of the naira, particularly as global oil prices have fluctuated.

The removal of

energy subsidies, while necessary for fiscal discipline, can lead to

inflationary pressures as fuel prices rise Umar and Nor (2024). This inflation can further weaken the

naira, creating a vicious cycle where the currency’s depreciation drives up

import costs, leading to more inflation. In the context of Nigeria, where many

goods, including fuel, are imported, the depreciation of the naira has

compounded the negative effects of subsidy removal on the cost of living.

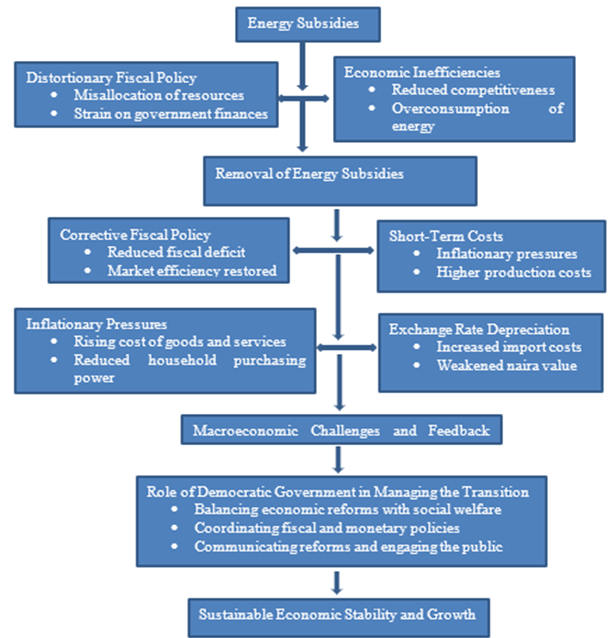

3. Conceptual Framework

The conceptual

framework for this research review integrates the relationship between energy

subsidies, fiscal policy, inflation, and exchange rate depreciation. At the

centre of this framework is the idea that energy subsidies represent a

distortionary fiscal policy that creates inefficiencies in the economy. These

inefficiencies, in turn, lead to a misallocation of resources, reduced

competitiveness, and a strain on government finances.

The removal of

energy subsidies is conceptualized as a corrective fiscal policy aimed at

restoring market efficiency and reducing the fiscal deficit. However, this

policy comes with significant short-term costs, including inflation and

currency depreciation, as prices adjust to market levels. The free fall of the

naira, driven by both structural weaknesses in the economy and the inflationary

effects of subsidy removal, exacerbates these challenges by increasing the cost

of imports and reducing the purchasing power of Nigerians.

The conceptual

framework also highlights the role of the democratic government in managing

this transition. In a democratic context, where public opinion and social

welfare are critical considerations, the government faces the challenge of

balancing economic reform with the need to maintain social stability. The

framework thus integrates fiscal policy, monetary policy, and political economy

considerations, emphasizing the need for a coordinated response that addresses

both the economic and social dimensions of subsidy removal and currency

depreciation.

Step-by-Step Breakdown of the Conceptual Framework

This conceptual framework examines the interconnected relationships between energy subsidies, fiscal policy, inflation, exchange rate depreciation, and political economy considerations. It aims to explain the economic and social dynamics resulting from the removal of energy subsidies in Nigeria.

1) Central

Role of Energy Subsidies

Energy subsidies are placed at the center of this framework as a distortionary fiscal policy with widespread economic implications.

Step 1: Identification of Energy Subsidies as Distortionary

· Reasoning: Energy subsidies artificially lower the cost of energy, leading to inefficiencies in the allocation of resources.

· Impact: These inefficiencies reduce the competitiveness of domestic industries and increase the fiscal burden on the government, leading to unsustainable budget deficits.

Step 2: Resource Misallocation

· Reasoning: Subsidies encourage overconsumption of subsidized energy products, reducing investments in alternative energy sources and hindering innovation.

· Impact: The economy becomes overly dependent on subsidized energy, limiting diversification and sustainable growth.

Step 3: Strain on Government Finances

· Reasoning: Subsidies consume a significant portion of government revenue, diverting funds away from critical investments in infrastructure, healthcare, and education.

· Impact: Persistent fiscal deficits and rising public debt exacerbate macroeconomic vulnerabilities.

2) Removal

of Energy Subsidies as Corrective Fiscal Policy

The removal of energy subsidies is conceptualized as a measure to correct economic inefficiencies and reduce fiscal deficits.

Step 1: Policy Rationale

· Reasoning: Eliminating subsidies restores market-based pricing, reducing resource misallocation and improving fiscal health.

· Impact: It frees up government resources for productive investments and fosters a more competitive economic environment.

Step 2: Short-Term Costs

· Reasoning: The transition to market-based pricing triggers immediate price adjustments, leading to higher energy costs for consumers and businesses.

· Impact: This result in inflationary pressures, reduced household purchasing power, and increased production costs for industries.

3) Inflation

and Exchange Rate Depreciation

The framework explores the inflationary effects of subsidy removal and their interaction with currency depreciation.

Step 1: Inflationary Impact of Subsidy Removal

· Reasoning: Removing subsidies increases the cost of energy products, which cascades through the economy, raising the prices of goods and services.

· Impact: Inflation reduces real incomes and worsens living standards, especially for low-income households.

Step 2: Exchange Rate Depreciation

· Reasoning: The inflationary pressures from subsidy removal, combined with structural weaknesses in the economy (e.g., reliance on imports), lead to a depreciation of the naira.

· Impact: Currency depreciation increases the cost of imports, further fueling inflation and eroding the purchasing power of Nigerians.

Step 3: Feedback Loop

· Reasoning: Inflation and exchange rate depreciation are interlinked, with one exacerbating the other in a reinforcing cycle.

· Impact: This creates a challenging macroeconomic environment that requires coordinated monetary and fiscal policy responses.

4) Role

of the Democratic Government in Managing the Transition

In a democratic context, the framework highlights the critical role of the government in balancing economic reforms with social stability.

Step 1: Balancing Economic Reform and Social Welfare

· Reasoning: In a democracy, public opinion and social welfare are significant factors that influence policy decisions.

· Impact: The government must address the economic rationale for subsidy removal while ensuring that the social impact is mitigated to maintain stability.

Step 2: Coordinated Policy Response

· Reasoning: Effective management of the transition requires coordination between fiscal and monetary policies to control inflation and stabilize the currency.

· Impact: Policies such as targeted social interventions (e.g., cash transfers) and monetary tightening can help mitigate the adverse effects on vulnerable populations.

Step 3: Communication and Public Engagement

· Reasoning: Clear communication about the rationale for subsidy removal and the long-term benefits is essential to gain public support.

· Impact: Transparency and engagement can reduce resistance and ensure smoother implementation of reforms.

Visualization of the Conceptual Framework

The conceptual framework can be visualized as follows:

Figure 1

|

Figure 1 Conceptual Framework |

This conceptual framework illustrates how energy subsidies distort fiscal policy, leading to inefficiencies, resource misallocation, and fiscal deficits. The removal of subsidies, while essential for restoring economic balance, generates short-term costs like inflation and currency depreciation. In a democratic context, managing this transition requires a coordinated policy approach that addresses both the economic and social dimensions of subsidy removal. This approach, if implemented effectively, can lead to sustainable economic stability and growth.

4. Research Methodology

In generating a

useful insight for this study, policy documents of Nigerian government,

international organizations and academic articles/research papers were analysed

to understand the official rationale behind subsidy removal and the strategies

proposed for mitigating the negative impact on the economy. Below are the

content analyses of the used policy documents, i.e., secondary data:

1)

Government

reports and policy documents:

These include budget reports, economic recovery plans, and subsidy reform

policies from the Ministry of Finance, the Nigerian National Petroleum

Corporation (NNPC), and the Central Bank of Nigeria (CBN).

2)

Academic

articles and research papers:

Peer-reviewed journal articles, working papers, and economic analyses related

to energy subsidies, fiscal policy, and currency depreciation in developing

economies, specifically Nigeria, were reviewed.

3)

International

financial institution reports: Data from the International Monetary Fund (IMF), the World Bank, and

other relevant organizations that monitor economic trends and provide policy

advice for Nigeria.

4)

Historical

data and statistics:

Historical economic data such as inflation rates, foreign exchange reserves,

naira exchange rates, and fuel price fluctuations obtained from institutions

like the Nigerian Bureau of Statistics (NBS), the World Bank, and IMF databases

were synthesized.

5. Results and Discussion

Historical

context of energy subsidies in Nigeria

Nigeria’s energy

subsidy program has a long history, dating back to the 1970s when the

government sought to shield citizens from the volatility of global oil prices Esekpa

et al. (2024). At the time, Nigeria was a major oil

exporter, and the government’s revenue was heavily dependent on oil exports.

The subsidies were justified as a means of redistributing the country’s oil

wealth to its citizens, ensuring that even the poorest Nigerians could afford

fuel and electricity Idris et

al. (2024).

Over time,

however, the subsidy program became a significant drain on government

resources. According to a 2020 report by the World Bank, Nigeria spent over $5

billion annually on fuel subsidies, representing a significant portion of the

national budget Jesuola (2024). This spending crowded out investment in

critical infrastructure, education, and healthcare, contributing to the

country’s slow economic development.

Despite several

attempts to remove or reduce subsidies, successive governments have faced stiff

opposition from the public and labor unions, leading to widespread protests and

strikes Afunugo

and Chukwukamma (2024). The most notable of these was in 2012 when

the government of President Goodluck Jonathan attempted to remove fuel

subsidies, leading to the Occupy Nigeria movement Joshua et al. (2024). The protests forced the government to

partially reinstate the subsidies, highlighting the political sensitivity of

the issue.

The impact of

subsidy removal on the economy

The removal of

energy subsidies is often seen as a necessary step to restore fiscal discipline

and promote economic growth Njoku et

al. (2024). In theory, subsidy removal should lead to

more efficient resource allocation, as prices reflect the true cost of

production Aigbe

and Oshoma (2024). This should encourage investment in the

energy sector, leading to increased supply and lower prices in the long run.

However, in the

short term, the removal of subsidies can have significant negative effects on

the economy. In Nigeria, the removal of fuel subsidies has led to a sharp

increase in the price of fuel, which in turn has driven up the cost of

transportation, food, and other goods Aruofor

and Ogbeide (2024). This has contributed to inflation,

reducing the purchasing power of Nigerians and increasing the cost of living.

The inflationary

effects of subsidy removal are compounded by the depreciation of the naira Oboro

and Agbamu (2024). As fuel prices rise, the demand for

foreign exchange to import fuel increases, putting further pressure on the

naira Aruofor

and Ogbeide (2024). The Central Bank of Nigeria (CBN) has

struggled to stabilize the currency, with the naira losing over 30% of its

value in 2023 alone Ogundele and Ibrahim (2024). This depreciation has made it more expensive for Nigeria to import

goods, leading to higher inflation and a further decline in living standards.

The role of

the democratic government

The current

democratic government, led by President Bola Tinubu, has taken steps to remove

energy subsidies as part of a broader economic reform agenda. In 2023, the

government announced the full removal of fuel subsidies, citing the need to

reduce the fiscal deficit and free up resources for development projects. This

move was welcomed by international financial institutions like the

International Monetary Fund (IMF) and the World Bank, which have long advocated

for the removal of subsidies.

However, the

removal of subsidies has also led to widespread public discontent, with many

Nigerians protesting the higher cost of living. The government has attempted to

mitigate the social impact of subsidy removal by introducing social welfare

programs, including cash transfers to vulnerable households. However, these

programs have been criticized as insufficient, with many Nigerians struggling

to cope with the rising cost of fuel and food.

The democratic

nature of Nigeria’s government adds a layer of complexity to the subsidy

removal debate. Unlike authoritarian regimes, which can implement unpopular

policies with little regard for public opinion, democratic governments must

balance economic reform with social stability. The government’s ability to

manage the fallout from subsidy removal will depend on its ability to

communicate the long-term benefits of the policy while providing short-term

relief to those most affected.

The way

forward

The way forward

for Nigeria in addressing the challenges posed by subsidy removal and the free

fall of the naira requires a multifaceted approach. First, the government must

prioritize fiscal discipline by ensuring that the savings from subsidy removal

are reinvested in critical sectors like infrastructure, education, and

healthcare. This will help to build public trust in the government’s reform

agenda and demonstrate that the removal of subsidies is in the long-term

interest of the country.

Second, the

government must work to stabilize the naira by addressing the structural

weaknesses in the economy that have contributed to its depreciation. This

includes diversifying the economy away from oil exports, improving foreign

exchange management, and encouraging investment in the non-oil sector. The CBN

should also adopt a more flexible exchange rate policy, allowing the naira to

adjust to market conditions while intervening when necessary to prevent

excessive volatility.

Third, the

government must strengthen social safety nets to protect the most vulnerable

Nigerians from the negative effects of subsidy removal. This could include

expanding cash transfer programs, improving access to affordable healthcare,

and providing targeted subsidies for essential goods like food and

transportation.

Finally, the

government must engage in a broader dialogue with stakeholders, including labor

unions, civil society, and the private sector, to build consensus around the

need for subsidy removal and economic reform. This will help to reduce the risk

of social unrest and ensure that the government’s policies are seen as

legitimate and fair.

6. Conclusion and Recommendation

The removal of

energy subsidies and the free fall of the naira represent two of the most

significant economic challenges facing Nigeria today. While the removal of

subsidies is necessary to restore fiscal discipline and promote long-term

economic growth, it has also led to short-term inflationary pressures and a decline

in living standards. The depreciation of the naira has compounded these

challenges, making it more difficult for Nigerians to afford basic goods and

services.

The current

democratic government must navigate these challenges carefully, balancing the

need for economic reform with the need to maintain social stability. This will

require a coordinated response that includes fiscal discipline, exchange rate

management, and targeted social welfare programs. The government must also

engage in a broader dialogue with stakeholders to build consensus around its

reform agenda and ensure that the benefits of subsidy removal are shared

equitably across society.

In conclusion, while the removal of energy subsidies and the depreciation of the naira present significant challenges, they also offer an opportunity for Nigeria to reset its economic trajectory and build a more sustainable and equitable future. The way forward will require bold leadership, careful planning, and a commitment to both economic reform and social justice.

CONFLICT OF INTERESTS

None.

ACKNOWLEDGMENTS

None.

REFERENCES

Adamu, S., & Hassan, U. (2024). Inflationary Pressures and the Removal of Energy Subsidies: the

Nigerian Experience. International Journal of Development Economics.

Adewale, B., & Yusuf, A. (2023). Balancing Subsidy Removal and Economic Growth in Nigeria. Nigerian

Economic Review.

Afunugo, K. N., &

Chukwukamma, K. E. (2024). Contemporary Mismanagement

of Public Finances in Nigeria: Ethical Insights on Tinubu’s Fuel Subsidy

Removal Revenues. Multidisciplinary Journal of Law, Education and Humanities,

1(2).

Aigbe, E. N., & Oshoma, B. O.

(2024). Subsidy Removal Policy: Analysis of Issues,

Challenges and the Way Forward in Nigeria.

Akinola, J. (2023). The Political Economy of Fuel Subsidy Removal in Nigeria: Current

Democratic Context. African Policy Journal.

Aruofor, R. O., & Ogbeide,

D. R. A. (2024). Simulation Analysis of President

Bola Tinubu’s Price Deregulation Policy on the Nigerian Economy: an Outlook to Year.

Bello, R., & Musa, Y. (2023). Corruption in Nigeria's Subsidy Regime: A Systemic Challenge.

Transparency and Governance Review.

Chukwunonso, R. D., Nosike,

J., Odey, O. J., & Chike, N. K. (2024). The Effect

of Fuel Subsidy Removal in Nigeria Economy in Keffi Local Government Area,

Nasarawa State. Ideal International Journal, 17(2).

Esekpa, O. I., Ekarika, W. A.,

& Njama, G. J. (2024). Economic Implications of

fuel Subsidy Removal in Nigeria: Challenges and Prospects. Journal of Public

Administration, Policy and Governance Research, 2(3), 197-206.

Fyneroad, Z. I. (2024). Fuel Subsidy Removal and its Implications on the Economic Rights of

Nigerians. Nnamdi Azikiwe University Journal of International Law and

Jurisprudence, 15(2), 224-234.

Idris, A., Kitabu, M. U., Musa, M.

M., & Shehu, A. (2024). Effect of Fuel Subsidy

Removal on Socio-Economic Development of Chanchaga Local Government Area of

Niger State. Kashere Journal of Politics and International Relations, 2(2),

340-354.

Idris, M., & Lawal, A.

(2024). The Role of Civil Society in Subsidy

Debates in Nigeria. Journal of African Civil Engagement.

Ijigah, E. A., & David, I. O.

(2024). Assessment of Subsidies for Construction

Businesses in Nigeria: Evolution from an Oil-based Economy to an Infrastructural-based

Economy. Journal of Techno-Social, 16(1), 66-80.

Jesuola, G. D. (2024). Impact of the Nigerian Government's Fuel Subsidy Removal: Data

Analysis and Suggestions. A Master's Thesis, Texas A&M

University-Kingsville.

Joshua, D., Dandaura, J., Umaru, D.

A., Sani, A., & Musa, I. C. (2024). Designing Appropriate

Compensation Mechanisms for Subsidy Removal in Nigeria: the Role of Fiscal

Policy.

Mbanefo, P. A. (2024). Petroleum Subsidy Removal and Socio-Economic Development in Nigeria.

African Banking and Finance Review Journal, 11(11), 171-182.

Nigerian National Petroleum

Corporation (NNPC) (2023).

Njoku, K. C., Dike, O. J., &

Anyanwu, R. C. (2024). Fuel Subsidy Removal as a Correlate

of Sustainable Organizational Agility in Owerri-based health facilities. West

African Journal on Sustainable Development, 1(2), 105-120.

Oboro, E. D., & Agbamu, M. E.

(2024). Fuel Subsidy Removal on the Economic

Welfare of Nigerians. International Journal of Applied Research, 10(5),

261-268.

Ogundele, T., & Ibrahim, M.

(2024). The Fiscal Impacts of Fuel Subsidies on

Nigeria’s Economy." Journal of African Economic Studies.

Ogunleye, A., & Salisu, R.

(2023). Impact of Fuel Price Increases on the Cost of

Living in Nigeria. Journal of Social and Economic Research.

Ogunmokun, O. (2024). Strategies for Mitigating the Impact of Naira Depreciation on

Nigerian Small-and Medium-Sized Enterprises. Doctoral Dissertation, Walden

University.

Olawale, S., & Ajiboye, O.

(2023). Macroeconomic Management and the Depreciation

of the Naira." Nigerian Journal of Finance and Development.

Sambo, U., & Sule, B. (2024). Killing the Economy: the Political Economy of fuel Subsidy Regime and Oil Corruption in Nigeria. In Economic Growth and Development in the Tropics, 159-175. Routledge. https://doi.org/10.4324/9781003349204-10

Umar, S., & Nor, R. M. (2024). The Assessment of Impacts of 2016 Fuel Subsidy Removal on Low Income Earners in Katsina Metropolis, Nigeria. Journal of Sustainable Development Practice, 1(1), 10-20. https://doi.org/10.59953/jsdp.v1i1.2

Usman, K., & Garba, A. (2023). Fuel Subsidy Removal and Market Efficiency in Nigeria. West African Economic Forum.

|

|

This work is licensed under a: Creative Commons Attribution 4.0 International License

This work is licensed under a: Creative Commons Attribution 4.0 International License

© ShodhPrabandhan 2025. All Rights Reserved.